Saturday, November 30, 2013

Friday, November 29, 2013

Morning Update for Friday, November 29th

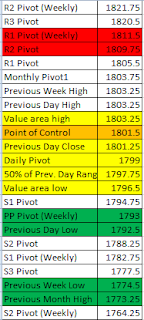

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Neutral

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:At POC

Notable overnight futures markets changes:

Up: SI (Silver), PA (Palladium), PL (Platinum), CC (Cocoa), GC (Gold), NG (Nat Gas), HG (Copper)

Down:--

News for the day:

NONE

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Given that it is the Friday after Thanksgiving and there is an early close for the markets, the high probability is for neutral, range bound price action. The overnight profile is evenly distributed between 1805 and 1810 and will be the points of reference for today. Look to fade resistance levels near the highs and support levels near the lows.

Stock of the Day: Silver ETF (SLV)

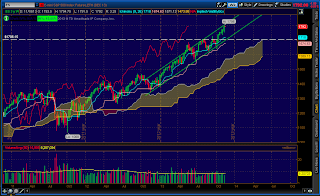

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Neutral

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:At POC

Notable overnight futures markets changes:

Up: SI (Silver), PA (Palladium), PL (Platinum), CC (Cocoa), GC (Gold), NG (Nat Gas), HG (Copper)

Down:--

News for the day:

NONE

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Given that it is the Friday after Thanksgiving and there is an early close for the markets, the high probability is for neutral, range bound price action. The overnight profile is evenly distributed between 1805 and 1810 and will be the points of reference for today. Look to fade resistance levels near the highs and support levels near the lows.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Wednesday, November 27, 2013

Morning Update for Wednesday, November 27th

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Neutral

Overnight Inventory Change: Neutral/long

Inside Day/Outside Day: Inside

Location of price relative to market profile:Near value area high

Notable overnight futures markets changes:

Up: Palladium (PA), SI (Silver), ZM (Soybean Meal), GC (Gold), NKD (Nikkei), ZW (Wheat), PL (Platinum), ZC (Corn), 6B (British Pound)

Down:

News for the day:

Durable Goods Orders: 8:30a

Jobless Claims: 8:30a

Chicago PMI: 9:45a

Petroleum Report: 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:The S&P has a spinning top candlestick pattern on the daily chart. This type of setup is indicative of more neutral price action in the short term and it fits given the Thanksgiving holiday. It is a surprisingly strong news day which possibly could provide some trading opportunities. The key points of reference will be 1807 to the top side and 1798.5 to the downside. Since most traders are already on Thanksgiving break, the higher probability is for an inside day and trades should be monitored carefully. Happy Thanksgiving!

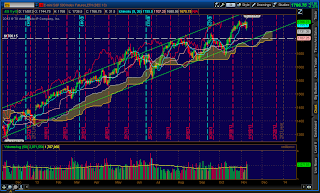

Stock of the Day: Hewlett-Packard Company (HPQ)

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Neutral

Overnight Inventory Change: Neutral/long

Inside Day/Outside Day: Inside

Location of price relative to market profile:Near value area high

Notable overnight futures markets changes:

Up: Palladium (PA), SI (Silver), ZM (Soybean Meal), GC (Gold), NKD (Nikkei), ZW (Wheat), PL (Platinum), ZC (Corn), 6B (British Pound)

Down:

News for the day:

Durable Goods Orders: 8:30a

Jobless Claims: 8:30a

Chicago PMI: 9:45a

Petroleum Report: 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:The S&P has a spinning top candlestick pattern on the daily chart. This type of setup is indicative of more neutral price action in the short term and it fits given the Thanksgiving holiday. It is a surprisingly strong news day which possibly could provide some trading opportunities. The key points of reference will be 1807 to the top side and 1798.5 to the downside. Since most traders are already on Thanksgiving break, the higher probability is for an inside day and trades should be monitored carefully. Happy Thanksgiving!

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Tuesday, November 26, 2013

Morning Update for Tuesday, November 26th

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:Value area low

Notable overnight futures markets changes:

Up: ZO (Oats), NG (Nat Gas), SI (Silver), GC (Gold)

Down: ZC (Corn), ZW (Wheat), NKD (Nikkei)

News for the day:

Housing Starts: 8:30a

Case-Shiller Home Index: 9:00a

Consumer Confidence: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:The S&P is poised to open neutral after the overnight trading activity and inside of Monday's range. Given the fact that it is Thanksgiving week, the higher probability is for more range bound trading, especially when prices are inside of the value area. There is a large volume zone from 1785-1795 and the ES should find support at the level if there is a liquidation break. Otherwise, if prices approach the high of Monday at 1806.75 then it should attract more buyers. At this point, it is a coin toss so trade accordingly.

Stock of the Day: Nuance Communications, Inc. (NUAN)

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:Value area low

Notable overnight futures markets changes:

Up: ZO (Oats), NG (Nat Gas), SI (Silver), GC (Gold)

Down: ZC (Corn), ZW (Wheat), NKD (Nikkei)

News for the day:

Housing Starts: 8:30a

Case-Shiller Home Index: 9:00a

Consumer Confidence: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:The S&P is poised to open neutral after the overnight trading activity and inside of Monday's range. Given the fact that it is Thanksgiving week, the higher probability is for more range bound trading, especially when prices are inside of the value area. There is a large volume zone from 1785-1795 and the ES should find support at the level if there is a liquidation break. Otherwise, if prices approach the high of Monday at 1806.75 then it should attract more buyers. At this point, it is a coin toss so trade accordingly.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Monday, November 25, 2013

Morning Update for Monday, November 25th

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Outside

Location of price relative to market profile: Above value area

Notable overnight futures markets changes:

Up: NG (Nat Gas), CT (Cotton), NKD (Nikkei), ZW (Wheat)

Down:RB (Heating Oil), CL (Crude Oil), HO (Heating Oil), GC (Gold), SI (Silver)

News for the day:

Pending Home Sales Index: 10:00a

Dallas Fed Mfg Survey: 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The S&P made a new all-time high during the overnight session and traders continue to buy these markets in droves. 1800 is a well defined trading level and should provide a strong area of support for the bulls, but the edge is clearly to the bulls until proven otherwise.

Stock of the Day: Ebay, Inc.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Outside

Location of price relative to market profile: Above value area

Notable overnight futures markets changes:

Up: NG (Nat Gas), CT (Cotton), NKD (Nikkei), ZW (Wheat)

Down:RB (Heating Oil), CL (Crude Oil), HO (Heating Oil), GC (Gold), SI (Silver)

News for the day:

Pending Home Sales Index: 10:00a

Dallas Fed Mfg Survey: 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The S&P made a new all-time high during the overnight session and traders continue to buy these markets in droves. 1800 is a well defined trading level and should provide a strong area of support for the bulls, but the edge is clearly to the bulls until proven otherwise.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Sunday, November 24, 2013

Friday, November 22, 2013

Morning Update for Friday, 11/22/13

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:Near value area high

Notable overnight futures markets changes:

Up: ZM (Soybean Meal), NG (Nat Gas), PA (Palladium), ZS (Soybean), HO (Heating Oil), ZO (Oats), OJ (Orange Juice), HG (Copper)

Down:CT (Cotton), SB (Sugar), 6A (Aussie Dollar), 6N (New Zealand Dollar)

News for the day:

NONE

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Prices are poised to open inside of yesterday's value area after the bullish activity. As a result, the logical point of reference is the previous day high at 1795.5. If prices can clear the level, then new buyers should be attracted to lift the offer higher. Anything inside of the value area would generate more two sided trading activity. For now, edge to the bulls.

Stock of the Day: Aruba Networks, Inc. (ARUN)

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:Near value area high

Notable overnight futures markets changes:

Up: ZM (Soybean Meal), NG (Nat Gas), PA (Palladium), ZS (Soybean), HO (Heating Oil), ZO (Oats), OJ (Orange Juice), HG (Copper)

Down:CT (Cotton), SB (Sugar), 6A (Aussie Dollar), 6N (New Zealand Dollar)

News for the day:

NONE

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Prices are poised to open inside of yesterday's value area after the bullish activity. As a result, the logical point of reference is the previous day high at 1795.5. If prices can clear the level, then new buyers should be attracted to lift the offer higher. Anything inside of the value area would generate more two sided trading activity. For now, edge to the bulls.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Thursday, November 21, 2013

Morning Update for Thursday, November 21st

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral/long

Inside Day/Outside Day: Inside

Location of price relative to market profile: Near value area low

Notable overnight futures markets changes:

Up: NKD (Nikkei), ZL (Soybean Oil), ZC (Corn), ZS (Soybean), PA (Palladium)

Down:CC (Cocoa), GC (Gold), 6J (Yen), 6A (Aussie Dollar), 6N (New Zealand Dollar), SI (Silver)

News for the day:

Jobless Claims: 8:30a

Producer Price Index: 8:30a

PMI Mfg Index: 8:58a

Philadelphia Fed Survey: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Yesterday's profile showed a double distribution after the Fed meeting announcement. There was a liquidation break as prices spent time below Tuesday's trading range, a bearish sign. Prices are relatively neutral during the overnight session and are set to open inside the value area. Therefore, the value area high/low will be the reference points to watch for the day. There has been some profit taking with the bulls and a volume cluster is building between 1785-1800, so the intraday edge is with the bears.

Stock of the Day: Sears Holding Corporation (SHLD)- Earnings report filed this morning

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral/long

Inside Day/Outside Day: Inside

Location of price relative to market profile: Near value area low

Notable overnight futures markets changes:

Up: NKD (Nikkei), ZL (Soybean Oil), ZC (Corn), ZS (Soybean), PA (Palladium)

Down:CC (Cocoa), GC (Gold), 6J (Yen), 6A (Aussie Dollar), 6N (New Zealand Dollar), SI (Silver)

News for the day:

Jobless Claims: 8:30a

Producer Price Index: 8:30a

PMI Mfg Index: 8:58a

Philadelphia Fed Survey: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Yesterday's profile showed a double distribution after the Fed meeting announcement. There was a liquidation break as prices spent time below Tuesday's trading range, a bearish sign. Prices are relatively neutral during the overnight session and are set to open inside the value area. Therefore, the value area high/low will be the reference points to watch for the day. There has been some profit taking with the bulls and a volume cluster is building between 1785-1800, so the intraday edge is with the bears.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Wednesday, November 20, 2013

Morning Update for Wednesday, 11/20/13

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:At POC

Notable overnight futures markets changes:

Up: NG (Nat Gas), CT (Cotton), ZL (Soybean Oil), KC (Coffee)

Down:GC (Gold), PL (Platinum), PA (Palladium), RB (Heating Oil)

News for the day:

CPI: 8:30a

Retail Sales: 8:30a

Business Inventories: 10:00a

Existing Home Sales: 10:00a

Petroleum Status Report: 10:30a

FOMC Minutes: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: We've been seeing mostly two-sided trading for the past few days and the overnight session generated similar results. At this point, the S&P looks to open inside Tuesday's range and right at the POC, making it a coin flip for intraday price action. Therefore, the clearance of previous day high/low will give further clues to any directional trading activity. There is significant news at 8:30a which should provide a catalyst for the bulls or bears. The path of least resistance is with the bears,however, as there is still a VPOC to fill all the way at 1763.25 after the bullish price activity last week.

Stock of the Day: Yahoo, Inc. (YHOO)- Announced buyback

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:At POC

Notable overnight futures markets changes:

Up: NG (Nat Gas), CT (Cotton), ZL (Soybean Oil), KC (Coffee)

Down:GC (Gold), PL (Platinum), PA (Palladium), RB (Heating Oil)

News for the day:

CPI: 8:30a

Retail Sales: 8:30a

Business Inventories: 10:00a

Existing Home Sales: 10:00a

Petroleum Status Report: 10:30a

FOMC Minutes: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: We've been seeing mostly two-sided trading for the past few days and the overnight session generated similar results. At this point, the S&P looks to open inside Tuesday's range and right at the POC, making it a coin flip for intraday price action. Therefore, the clearance of previous day high/low will give further clues to any directional trading activity. There is significant news at 8:30a which should provide a catalyst for the bulls or bears. The path of least resistance is with the bears,however, as there is still a VPOC to fill all the way at 1763.25 after the bullish price activity last week.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Tuesday, November 19, 2013

Morning Update for Tuesday, November 19th

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:Below value area

Notable overnight futures markets changes:

Up: ZW (Wheat), ZO (Oats), NG (Nat Gas), 6A (Aussie Dollar)

Down:--

News for the day:

Employment Cost Index: 8:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:Yesterday was the first bearish day we've seen in what seems like a long time. The late afternoon liquidation break saw the bulls do some profit taking and the bears riding the wave of the selloff. As a result, the point of reference for today will be Monday's low of 1784.75. If prices can clear and hold then there is room to run to the previous week's high. On the other hand, if the bulls can keep the market within Monday's range, then there should be more choppy action, particularly if prices climb back into the value area. Longterm edge clearly still is with the bulls, but the path of least resistance on an intraday basis is with the bears.

Stock of the Day: Salesforce.com (CRM)

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:Below value area

Notable overnight futures markets changes:

Up: ZW (Wheat), ZO (Oats), NG (Nat Gas), 6A (Aussie Dollar)

Down:--

News for the day:

Employment Cost Index: 8:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:Yesterday was the first bearish day we've seen in what seems like a long time. The late afternoon liquidation break saw the bulls do some profit taking and the bears riding the wave of the selloff. As a result, the point of reference for today will be Monday's low of 1784.75. If prices can clear and hold then there is room to run to the previous week's high. On the other hand, if the bulls can keep the market within Monday's range, then there should be more choppy action, particularly if prices climb back into the value area. Longterm edge clearly still is with the bulls, but the path of least resistance on an intraday basis is with the bears.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Monday, November 18, 2013

Morning Update for Monday, November 18th

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Inside

Location of price relative to market profile:Above value area

Notable overnight futures markets changes:

Up: SB (Sugar), NG (Nat Gas)

Down:ZC (Corn), RB (Heating Oil), SI (Silver), ZO (Oats), PL (Palatium), NKD (Nikkei), HO (Heating Oil), GC (Gold), CL (Crude Oil)

News for the day:

Treasury International Capital: 9:00a

Housing Market Index: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:The S&P is poised to open near Friday's high and once again made a new all-time high during the overnight session. This type of price action is very bullish because it is indicative that traders overseas are finding value in the markets and are lifting offers even before the US markets open for business. Similar to Friday, the previous day high of 1796 will be the line in the sand. If prices hold above, then continued buying pressure should be expected. Bears, tread carefully. Edge to the bulls.

Stock of the Day: Boeing Co. (BA)- New buy orders by Middle Eastern companies

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Inside

Location of price relative to market profile:Above value area

Notable overnight futures markets changes:

Up: SB (Sugar), NG (Nat Gas)

Down:ZC (Corn), RB (Heating Oil), SI (Silver), ZO (Oats), PL (Palatium), NKD (Nikkei), HO (Heating Oil), GC (Gold), CL (Crude Oil)

News for the day:

Treasury International Capital: 9:00a

Housing Market Index: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:The S&P is poised to open near Friday's high and once again made a new all-time high during the overnight session. This type of price action is very bullish because it is indicative that traders overseas are finding value in the markets and are lifting offers even before the US markets open for business. Similar to Friday, the previous day high of 1796 will be the line in the sand. If prices hold above, then continued buying pressure should be expected. Bears, tread carefully. Edge to the bulls.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Sunday, November 17, 2013

Cloud Trader Weekend Update 11/17/13

A review of the week that was in the markets and a preview of the week ahead.

Friday, November 15, 2013

Morning Update for Friday, November 15th

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Outside

Location of price relative to market profile:Above value area

Notable overnight futures markets changes:

Up: KC (Coffee), NKD (Nikkei), CT(Cotton), 6N (New Zealand Dollar)

Down:SB (Sugar), PA (Palladium), ZM (Soybean Meal)

News for the day:

Empire State Mfg Survey: 8:30a

Import & Export Prices: 8:30a

Industrial Production: 9:15a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The bias continue to be to the top side as prices have made another all-time high during the overnight session. As a result, the key level of support will be the previous day high of 1789. If there is any selling at the open and buyers prop prices above the level, then continued buying should be expected. Prices typically don't make highs during the European session, so the higher probability is at least a test of the price point. At this point, the bears will look to get prices within yesterday's range, but they have their work cut out for them. Edge to the bulls.

Stock of the Day:Exxon Mobil (XOM)- Warren Buffett purchased large stake in company

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Outside

Location of price relative to market profile:Above value area

Notable overnight futures markets changes:

Up: KC (Coffee), NKD (Nikkei), CT(Cotton), 6N (New Zealand Dollar)

Down:SB (Sugar), PA (Palladium), ZM (Soybean Meal)

News for the day:

Empire State Mfg Survey: 8:30a

Import & Export Prices: 8:30a

Industrial Production: 9:15a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The bias continue to be to the top side as prices have made another all-time high during the overnight session. As a result, the key level of support will be the previous day high of 1789. If there is any selling at the open and buyers prop prices above the level, then continued buying should be expected. Prices typically don't make highs during the European session, so the higher probability is at least a test of the price point. At this point, the bears will look to get prices within yesterday's range, but they have their work cut out for them. Edge to the bulls.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Subscribe to:

Posts (Atom)