Saturday, August 31, 2013

Open Trading Positions as of 8/31/13

UVXY working well. First target is $49.90. Once reached, stop price will be moved to B/E @ $43.85. Second target is $54.90. Final target is open based on price action.

GMCR is the only trade in the red and will be watched closely if the bulls continue to cover their positions.

Friday, August 30, 2013

Morning Update for Friday, 8/30/13

*For FREE lessons on the Ichimoku Cloud and how it works, check out my other

blog-

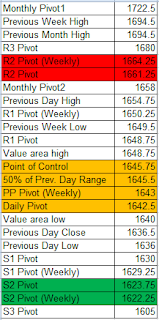

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile: at POC

Notable overnight futures markets changes:

Up:

Down: NKD, SI, GC, CL

News for the day:

Personal Income: 8:30a

Chicago PMI: 9:45a

Consumer Sentiment: 9:55a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Neutral. The ES is set to open inside the value area, meaning that neither the bulls nor the bears have an edge and that prices are at the fairest level to do business. Watch for a test of the previous day's high and low to see if either side can gain some traction. For now, the market is setting up for an inside day especially given that is the Friday before a holiday weekend which tends to produce more balanced price action.

Stock of the Day: Salesforce.com (CRM)

Earnings after the bell last night

ES Daily Trend: Neutral

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Thursday, August 29, 2013

Morning Update for Thursday, 8/29/13

*For FREE lessons on the Ichimoku Cloud and how it works, check out my other

blog-

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change:Net long

Inside Day/Outside Day:Inside

Location of price relative to market profile: Near POC

Notable overnight futures markets changes:

Up: NKD, DX

Down:SI, CL, 6E, 6J, GC

News for the day:

GDP: 8:30a

Jobless claims: 8:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Neutral. Prices are set to open within the value area so choppy price action is expected. If prices rise above the previous day high of 1639.25 then edge to the bulls and if prices sell off below 1624.75 then sellers will look to continue the bearish momentum. Watch the speed and tempo of the tape at these levels and at value area high/low.

ES Daily Trend: Neutral

ES Monthly Trend: Strongly Bullish

Wednesday, August 28, 2013

Morning Update for Wednesday, 8/28/13

*For FREE lessons on the Ichimoku Cloud and how it works, check out my other

blog-

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bearish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile: At value area low

Notable overnight futures markets changes:

Up: CL, SI

Down: 6A, HG

News for the day:

Pending Home Sales: 10:00a

Petroleum Status: 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Neutral/bearish. After Tuesday's big selloff, the bears will look to continue the momentum lower. 1624 is a key level to watch as it is the base of the channel on the daily chart as well as near the previous day low and is an area the bulls will seek to protect. If prices can hold within the daily range, then the higher probability is for a balance day.

Stock of the Day: United States Oil ETF (USO)

52 Week Highs

ES Daily Trend: Neutral

ES Weekly Trend: Bullish

ES Monthly Trend: Strongly Bullish

Tuesday, August 27, 2013

Morning Update for Tuesday, 8/27/13

*For FREE lessons on the Ichimoku Cloud and how it works, check out my other

blog-

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bearish

Overnight Inventory Change: Net Short

Inside Day/Outside Day: Outside

Location of price relative to market profile: Below value area

Notable overnight futures markets changes:

Up: GC, SI, CL

Down:NKD, NG, ZC, Indexes

News for the day:

Case-Shiller Index: 9:00a

Consumer Confidence: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Bearish. Trading has been almost all on the sell side during the overnight session. It will be important to see how prices act at the open. If there is some short covering then the bulls might be able to gain some traction and lift prices to test the previous day low of 1653.25. However, if there is a liquidation break and bears take prices through the previous week low of 1636 with some momentum then ride the wave of selling.

Stock of the Day: Omnivision (OVTI)

Bullish cloud break

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Monday, August 26, 2013

Morning Update for Monday, 8/26/13

*For FREE lessons on the Ichimoku Cloud and how it works, check out my other

blog-

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change:Neutral

Inside Day/Outside Day:Inside

Location of price relative to market profile: At value area high

Notable overnight futures markets changes:

Up:ZS, ZC, ZL, ZO, ZW, NG, SI

Down: NKD

News for the day:

Durable Goods Orders: 8:30a

Dallas Fed Mfg Survey: 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Neutral/Bullish. The ES is set to open within Friday's range near the value area high and buyers will look to test the high of 1662.75. If more bulls step in and time is spent above the level, then continued buying will be likely. Otherwise, another balanced day could be expected. Keep in mind that we are in the B Wave of the Elliott Wave pattern, so short term daily bias is bullish (check out the 8/25/13 weekend update video for Elliott Wave details).

Stock of the Day:Halliburton (HAL)

At 52 week highs

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Sunday, August 25, 2013

Cloud Trader Weekend Update 8/25/13

Weekly Cloud Analysis of the week that was in the markets and predictions for the week ahead! Volatility was high after the FOMC minutes on Wednesday. Should a selloff be expected?

Friday, August 23, 2013

Morning Update for Friday, 8/23/13

*For FREE lessons on the Ichimoku Cloud and how it works, check out my other

blog-

Major Support/Resistance Levels- ES

News for the day:

New Home Sales: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Stock of the Day:Powershares QQQ (QQQ)

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Thursday, August 22, 2013

Morning Update for Thursday, 8/22

*For FREE lessons on the Ichimoku Cloud and how it works, check out my other

blog-

Major Support/Resistance Levels- ES

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change:Bullish

Inside Day/Outside Day: Inside

Location of price relative to market profile: Between POC & value area low

Notable overnight futures markets changes:

Up:NG, CT, DX, Indexes

Down: ZC, ZS, 6J, ZW, 6S, ZB, 6E

News for the day:

Jobless Claims: 8:30a

PMI Manufacturing Index: 8:58a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Prices look to open within the value area after yesterday's roller coaster in price action after the FOMC minutes. The overnight volume is mostly long so the bulls will look to generate momentum and lift prices above the value area high of 1648.75. Sellers will look to test the 1636 level and if the bears can gain some traction the next level of support is at 1630.

Stock of the Day: Abercrombie & Fitch (ANF)

*Bearish cloud break heading into earnings

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Wednesday, August 21, 2013

Morning Update for Wednesday, 8/21/13

*For FREE lessons on the Ichimoku Cloud and how it works, check out my other

blog-

Major Support/Resistance Levels- ES

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change:Net short

Inside Day/Outside Day:Inside

Location of price relative to market profile: Below value area

Notable overnight futures markets changes:

Up:NG, ZS, ZW

Down:CT, HG, GC, SI

News for the day:

Existing Home Sales: 10:00a

Petroleum Report: 10:30a

FOMC Minutes: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The ES is set to open lower as traders were net short in the overnight session. Prices should test Monday's low @ 1643.25, which will serve as a support area for the bulls. If bears can push prices through the level, then the higher probability is for continued selling. On the other hand, if bulls can hold the area, then continued value will be built in the 1645-1650 range.

Stock of the Day:Target (TGT)

*Earnings before the bell

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Tuesday, August 20, 2013

Morning Update for Tuesday, 8/20/13

*For FREE lessons on the Ichimoku Cloud and how it works, check out my other

blog-

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change:Neutral

Inside Day/Outside Day:Inside

Location of price relative to market profile: Below value area

Notable overnight futures markets changes:

Up:ZB

Down:NKD, SI, CT, ZS, ZC, CL

News for the day:

NONE

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Neutral/bearish. Prices are set to open inside Monday's range. The natural test for the bears will be the previous day low at 1642.25. From there, the next confluence area of support is at 1635. However, if bulls can lift the offer, then the likelihood is for prices to trade within the value area.

Stock of the Day:Home Depot (HD)

Earnings before the bell

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

Subscribe to:

Posts (Atom)