Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change:Net long

Inside Day/Outside Day:Inside

Location of price relative to market profile: Near POC

Notable overnight futures markets changes:

Up: PL (Platinum), SI (Silver), PA (Palladium), CT (Cotton)

Down:SB (Sugar), ZW (Wheat), ZO (Oats), NG (Nat Gas)

News for the day:

Chicago PMI: 9:45a

Dallas Fed Mfg Survey: 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

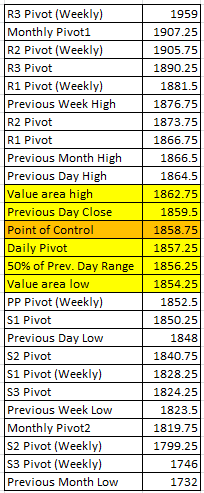

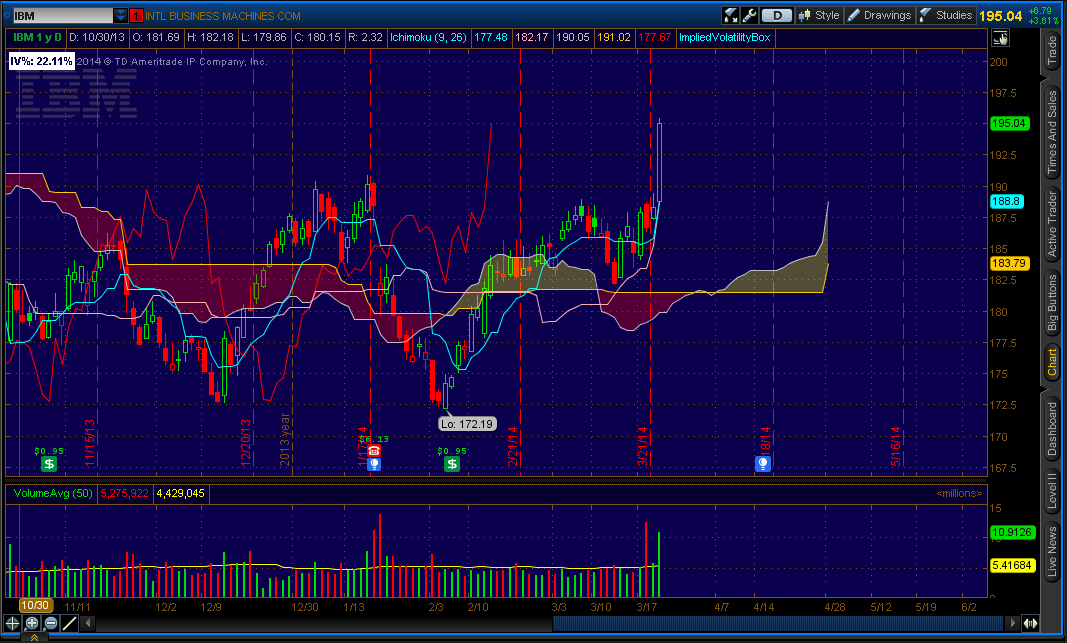

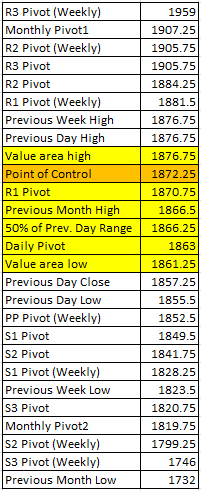

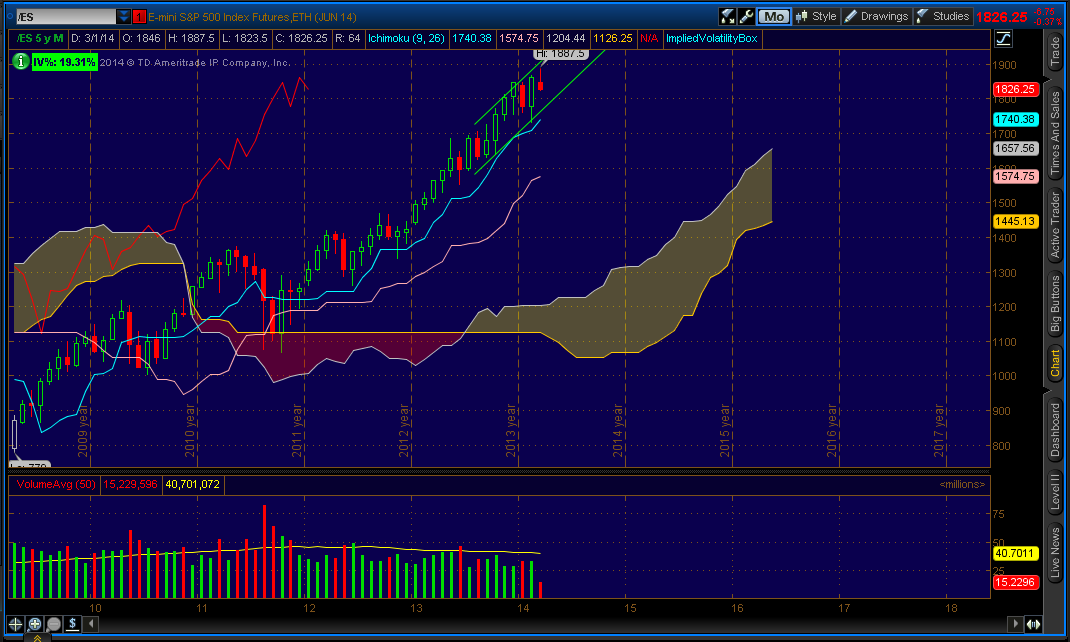

Projected ES price action for the day: Like bees to honey, the S&P has again gravitated to the composite high volume node between 1835-1870. On the daily chart, the candlesticks for the past couple of weeks have displayed wide range bars in both directions with wicks, which is indicative of higher volatility in the context of range bound trading. The higher probability is for continued price activity and smaller trade sizes should be used until the ES can clear the zone in either direction. Although the market is up during the globex session, it is trading right at the POC (point of control) from Friday. Intraday bias is a coin toss until there is a breakout of the previous day's high/low.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish