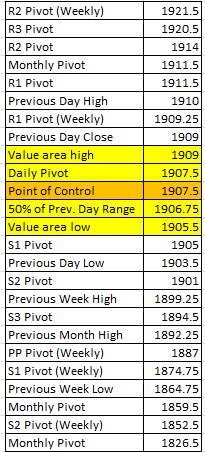

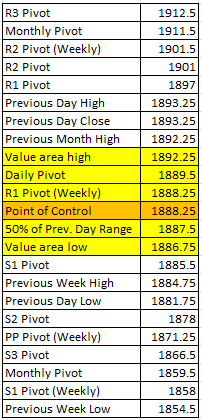

Major Support/Resistance Levels- ES

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change:Neutral

Inside Day/Outside Day:Inside

Location of price relative to market profile:Near value area high

Notable overnight futures markets changes:

Up:ZO (Oats), CC (Cocoa), CT (Cotton)

Down: KC (Coffee), ZL (Soybean Oil), SB (Sugar)

News for the day:

Personal Income & Outlays: 8:30a

Chicago PMI: 9:45a

Consumer Sentiment: 9:55a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The S&P continued its journey to record levels as another all-time high was made yesterday. It marked the seventh consecutive day where the value area has risen, a sign that large investors are confirming the up move since both time and volume are making higher highs. The Dow and Nasdaq are near all-time highs as well and, if record levels are made in these markets, it should provide further fuel to the bullish nature of the indexes. Trading has been neutral during the premarket, but long term since remains bullish.

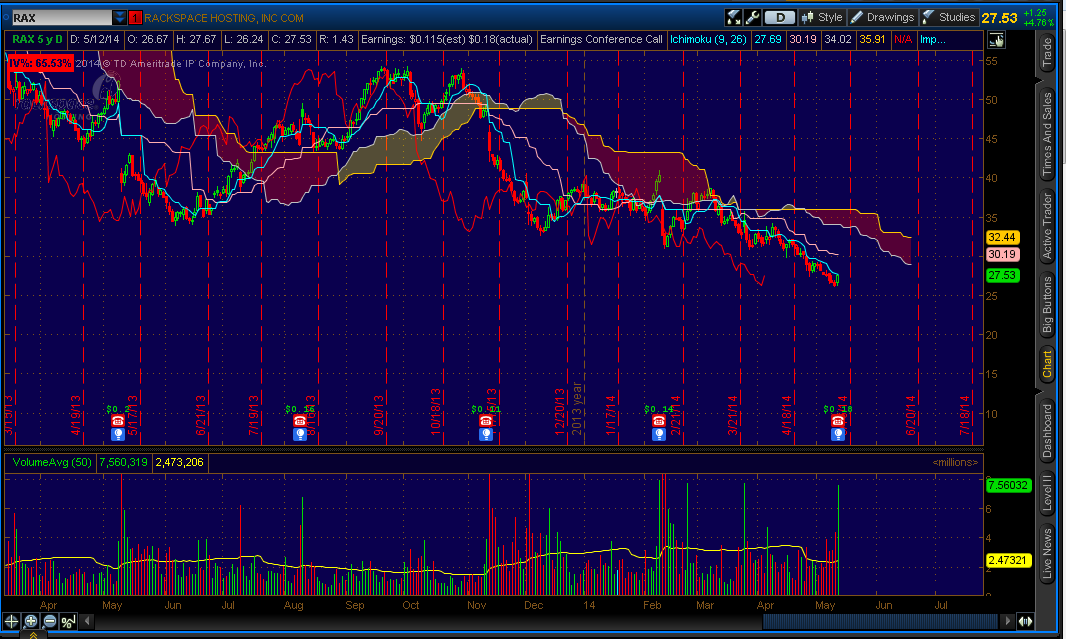

Stock of the Day: Splunk (SPLK)- Up 2% yesterday

ES Daily Trend: Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish