We all know what it's like to see drawdowns to the account. There are so many mixed feelings of anger, frustration, and doubt while in search of a consistently profitable strategy. As a result, here are some ideas to consider as you seek to grow as a trader and find your place in the market:

1.

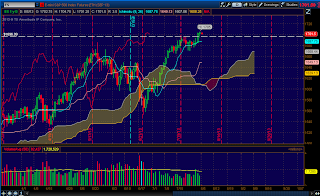

Keep it simple- If you have handfuls of indicators on your charts and can barely see the price action then your trading strategy is likely too complex. Always remember that the market is nothing more than a place where buyers and sellers meet to do business. Look for the imbalance between buyers and sellers as seen on the price charts and on the time & sales and capitalize on the opportunities. Remember, trading is simple, but not easy.

2.

Look in the mirror- Consider how you are feeling before each trading day. The trades you take and decisions you make are a reflection of your personality and the trading results mirror your P/L for the day. If your heart is beating and there is uncertainty before placing a trade, then it would be wise to skip it, even if it is a setup in your trading plan. Unless you use 100% automated strategy, your psychology outweighs a trading setup.

3.

Don't strategy hop-If you are a new trader and find that you are jumping from strategy to strategy in search of the "holy grail" then you should not be trading a live account. There is not a trader on earth with a 100% win rate. The key is to find a strategy that is consistently profitable which has at least a 2:1 risk/reward ratio.

4.

Practice on a demo account- Any strategy should be tested on a demo/simulator for at least a month, if not longer, before trading live. It is essential to prove to yourself that you are comfortable with the strategy (especially after getting stopped out) and have confidence that it will work in various market conditions.

5.

Find a strategy that fits your personality- There are a million different ways to be profitable in the marketplace. You need to find one that matches who you are. If you don't like to stare at a screen for hours at a time then day trading might not be for you. If you are comfortable letting a trade run and taking bigger risks, then swing trading could be a match. If you enjoy math and complex probabilities, then give options trading a try.

We've all been there before when trading doesn't go our way. Have the discipline, patience, and persistence to find a tested strategy that fits your personality and you can be a successful trader too.