Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Net short

Inside Day/Outside Day:Outside

Location of price relative to market profile: Below value area

Notable overnight futures markets changes:

Up: OJ (Orange Juice)

Down:ZO (Oats), NKD (Nikkei), ZL (Soybean Oil), SB (Sugar), ZS (Soybeans), NQ (Nasdaq)

News for the day:

PPI-FD: 8:30a

Consumer Sentiment: 9:55a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

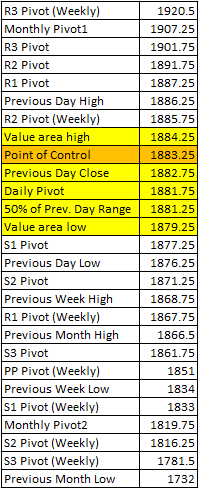

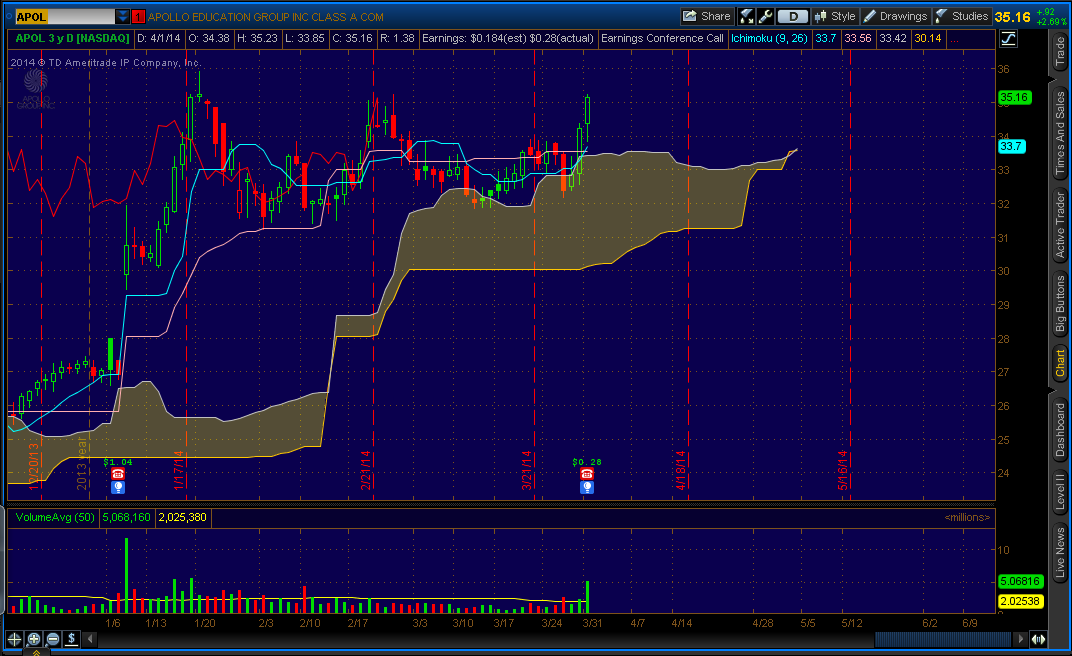

Projected ES price action for the day: The bears are starting to come out of hibernation on all of the indexes, especially the Nasdaq. The market makers lured in buyers after Wednesday's Fed news in lifting the offers and making the market appear to be strong, only to dump the contracts/shares in a big way yesterday. Not only did the ES trade below the high volume node of 1830, it also closed below the 50 day MA for the first time in two months. It is necessary to keep the location of prices in mind and the overall context in which the market is trading. We are still in a long term uptrend but velocity is beginning to pick up to the downside. The 50 DMA @ 1838 and the pivot levels will be significant to watch for today as intraday traders will be looking to buy/short at these points. Intraday edge is bearish.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish