Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change:Net long

Inside Day/Outside Day:Inside

Location of price relative to market profile: Between POC & Value area high

Notable overnight futures markets changes:

Up: NG (Nat Gas), NKD (Nikkei), PL (Platinum), Indexes

Down:KC (Coffee), ZW (Wheat), ZC (Corn), ZO (Oats), ZS (Soybeans), ZM (Soybean Meal), ZL (Soybean Oil)

News for the day:

Empire State Mfg Survey: 8:30a

Treasury International Capital: 9:00a

Industrial Production: 9:15a

Housing Market Index: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

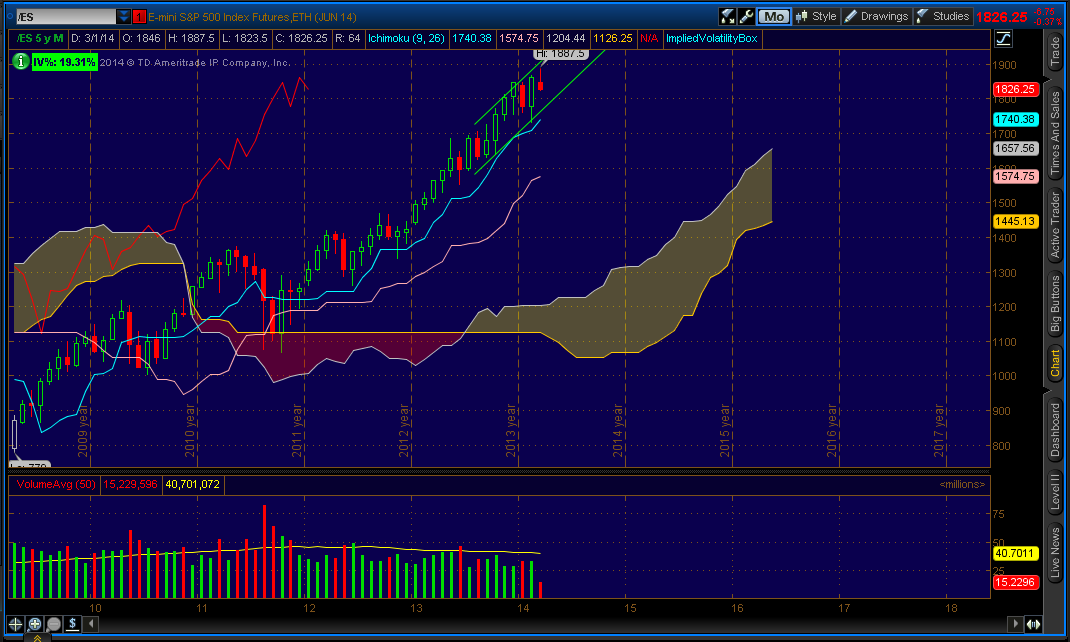

Projected ES price action for the day: We have officially entered March Madness and everyone will be filling in their tournament brackets. When considering the teams most likely to win, it is wise to consider the probability of the seeds playing each other when making the pick. For example, there is a much greater chance of an 8 eed upsetting a 9 then a 16 seed upsetting a 1. Similarly, the markets can be looked at as a game of probabilities. When the markets are in trending mode, as has been the case for the past year, and are flowing in one direction intraday with confirmation from the internals, then the high probability for a breakout trade is much higher than when there is mixed market breadth and the ticks have been trading in a range for the entire day. Currently, the S&P is in more of a horizontal trading pattern after selling off last week from the all-time highs. When the bears try to wrestle the price action from the bulls and switch the market sentiment, there is typically an increase in volatility and more whippy, two-sided price action until the trend continuation or trend reversal is confirmed. Intraday bias is neutral/bias.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish