Mastercard is poised to report its second quarter earnings on Tuesday, 7/31/13, before the bell at 9:00am.

The consensus is for the payment processing company to earn $6.30 a

share, according to analysts, which is an implied growth of 11.5% from $5.65 a share last

year.

Mastercard has developed a track record of consistent results with earnings exceeding expectations in

all of the past four quarters. Quarterly

sales are expected to grow 9.9% to $2 billion from $1.82 billion

in the same quarter last year while the company has averaged

annual revenue growth at 8%. In the first

quarter, Mastercard reported a 12% increase in gross dollar volume to $947 billion and an increase in processed transactions of 12

percent to 8.7 billion.

Mastercard results has seen profits grow due to an improving consumer spending environment as a greater number of worldwide

consumers are preferring electronic payments instead of cash and checks.

Some key areas to note for investors will be the slower than average card spending growth at Mastercard's

biggest client, Citibank, in addition to forex fluctuations overseas, especially in Europe, which may impact top-line growth.

Taking a glance at its competitors in the space, Visa posted a

quarterly profit of $1.23 billion compared

to a loss of $1.84 billion last year and operating revenues for the quarter grew to $3.00 billion from

$2.57 billion last year.

Analysts have a positive opinion on MasterCard as 24 out the 35

analysts covering the stock have a "strong buy" or "buy" rating while

the remaining 11 rate it as "hold."

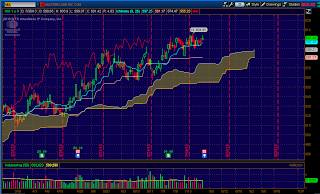

From an Ichimoku technical perspective, all signs are bullish with price, tenkan, kijun, and chikou above the cloud, together with a bullish cloud future. The key levels are:

All-time high: 604.85

Tenkan: 597.25

Kijun: 581

Cloud high: 574.75