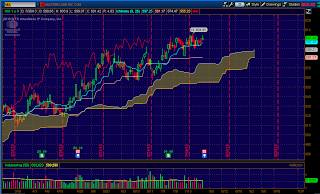

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Neutral

Overnight Inventory Change:Net long

Inside Day/Outside Day:Inside

Location of price relative to market profile: Near value area high

Notable overnight futures markets changes:

Up:SI, GC, 6J

Down:NKD, ZC

News for the day:

ADP Employment Report: 8:15a

GDP: 8:30a

Employment Cost Index: 8:30a

Chicago PMI: 9:45a

Petroleum Status Report: 10:30a

FOMC Announcement: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The two-sided price action continued again yesterday with the market building a significant amount of value between 1681-1685, which will be a key reference area for today. Higher volatility can be expected given the news catalysts for the day with the most significant being the GDP report and FOMC announcement. The ES tends to trade sideways after the Euro close and before the FOMC news, but solid price action should resume after 2pm as new traders enter the market.

Stock of the Day:Mastercard Inc. (MA)

Earnings before the bell. See blog post for details.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment