*For FREE lessons on the Ichimoku Cloud and how it works, check out my other

blog-

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Neutral

Overnight Inventory Change:Net long

Inside Day/Outside Day:Outside

Location of price relative to market profile: Above value area

Notable overnight futures markets changes:

Up:NKD, ZS, CL, SB, ZC, Indexes

Down:6J, CC, ZB, GC

News for the day:

Retail Sales: 8:30a

Import & Export Prices: 8:30a

Business Inventories: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The ES is set to open higher based on the overnight activity and there should be some volatility in the markets given the news catalysts for the day, especially the retail sales. As mentioned in the weekend update, 1676-1678 is the key support area for the bulls to hold and is where prices bounced off of yesterday. On the flipside, bears will be looking to sell the previous week high of 1705. If prices can rise above, then edge to the bulls.

*Dotted white lines indicate virgin point of control (VPOC)

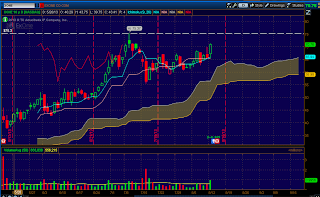

Stock of the Day:ExOne

Earnings After the Bell. *See blog post for cloud analysis

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment