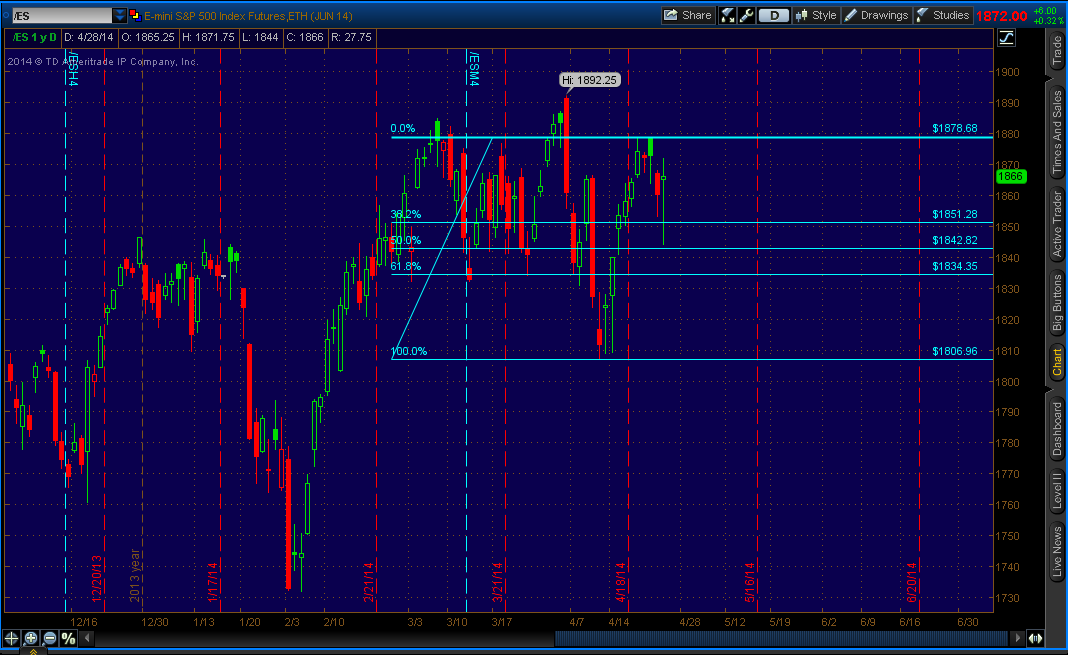

Major Support/Resistance Levels- ES

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day:Inside

Location of price relative to market profile: Above value area

Notable overnight futures markets changes:

Up: ZC (Corn), 6C (Canadian Dollar), CC (Cocoa)

Down: SI (Silver), NG (Nat Gas), GC (Gold), ZB (Bonds), ZW (Wheat)

News for the day:

Case-Shiller Home Price Index: 9:00a

Consumer Confidence: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Yesterday's trading saw a roller coaster of activity with the S&P trading in a 28 handle range only to close within 1 point of the level at the open. The market caught a bid at the 50% fibonacci retracement from the April 11th low to the April 24th high and could see further continuation buying today. The Fed meeting begins today and continues Wednesday with the FOMC minutes to be announced at 2pm tomorrow. When there is a Fed event, it often attracts longer term macro and fundamental investors who reposition their portfolio based on the economic news and provide added volatility to the day and swing traders who look to capitalize on short term directional market moves. There has been buying during the premarket up to Monday's high of 1871.75 and will be the level to watch when the market opens for business. Any activity above the price is more bullish as buyers lift the offers above the previous day's range. Intraday edge is neutral/bullish.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish

No comments:

Post a Comment