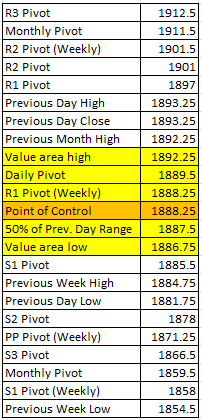

Major Support/Resistance Levels- ES

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Outside

Location of price relative to market profile: Above value area

Notable overnight futures markets changes:

Up:SB (Sugar), ZL (Soybean Oil), ZM (Soybean Meal), ZS (Soybeans), CL (Crude Oil), NKD (Nikkei), ZC (Corn), HO (Heating Oil), KC (Coffee)

Down:ZO (Oats), CT (Cotton)

News for the day:

Retail Sales: 8:30a

Import & Export Prices: 8:30a

Business Inventories: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

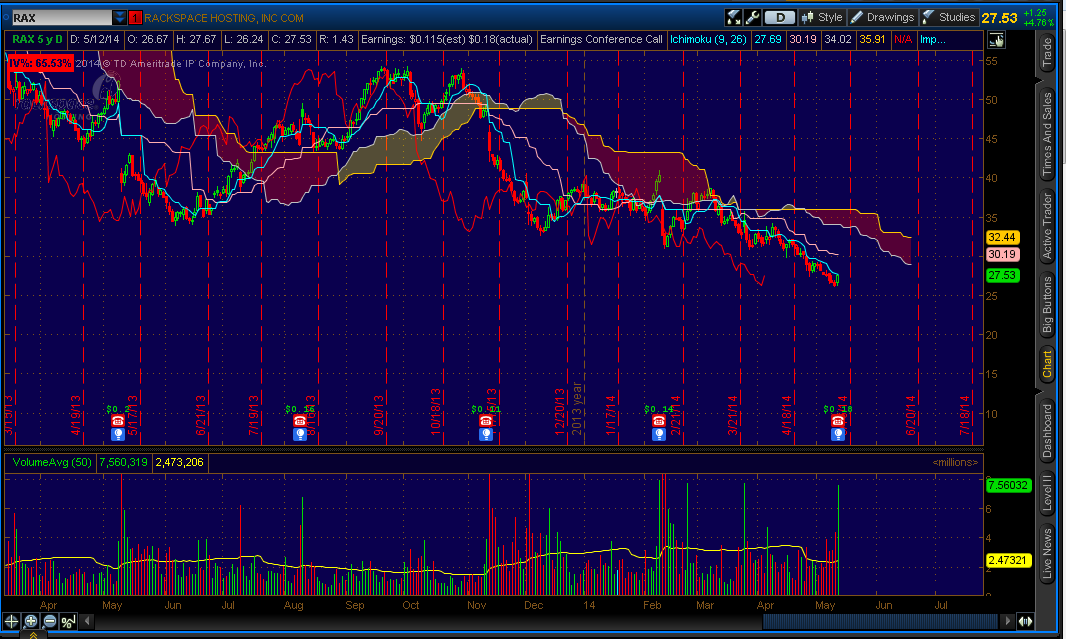

Projected ES price action for the day: It's up up and away once again as the S&P made all-time highs yesterday. After a month of consolidation above the cloud, the markets finally built enough momentum to set a new record and rise through the high volume composite node. Clearly, bear traders set their stop orders above the previous all-time high with the expectation for a bounce which triggered additional buying intraday yesterday as they were forced to cover their positions. One point of note is the relationship between the closing price and the point of control (POC) for the day. Prices closed right at the highs while the POC remained below at 1888, potentially creating a situation where traders could be long in the hole as prices migrate back to the POC. There has been some mild buying during the globex session to another high, making the open significant to watch if for some kind of liquidation. Longterm bias remains bullish.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish

No comments:

Post a Comment