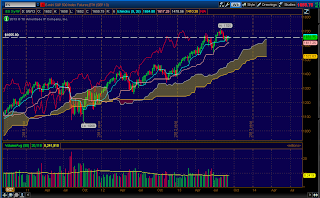

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bullish

Overnight Inventory Change:Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile: At value area high

Notable overnight futures markets changes:

Up: RB, HO, CL, 6J

Down: SI, GC, HG, PL, NKD, ZC, NG

News for the day:

Jobless Claims: 8:30a

Import and Export Prices: 8:30a

Treasury Budget: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Neutral/Bullish. Prices continue to hold near yesterday's highs during the premarket session which is a sign that there is more demand than supply. 1689 will be the line in the sand as it is both the value area high and Wednesday's high. If prices move up and hold then another bullish day can be expected and trading long would be higher probability. If bears keep the ES inside the range then choppy price action would be likely, so keep tighter stops when trading in the value area.

Reported earnings. Down 8% in the premarket

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment