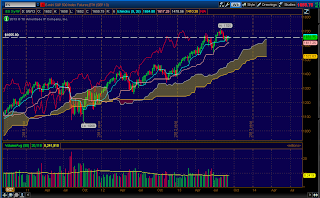

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Inside

Location of price relative to market profile: At POC

Notable overnight futures markets changes:

Up: NKD, NG, ZS, Indexes

Down:SI, ZW, CL

News for the day:

NONE

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Neutral/bullish. The ES looks to open within the value area, right at the POC, which is a neutral sign. Given the large volatility on Friday after the jobs report and the roller coaster ride between the bulls and bears, a wide value area was created. Since markets tend to balance after large intraday swings and that there is no news catalysts today, the higher probability is to fade the value area high and low. Of course, watch the tape around these levels before taking any trades.

Stock of the Day: Facebook (FB)

*At 52 week highs

ES Daily Trend: Neutral

ES Weekly Trend: Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment