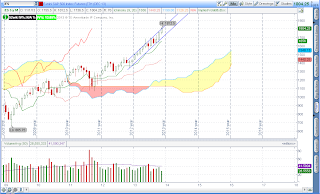

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:Below value area

Notable overnight futures markets changes:

Up: CC (Cocoa), ZM (Soybean Meal), 6N (New Zealand Dollar), ZS (Soybeans)

Down: SI (Silver), GC (Gold), ZO (Oats), ZB (Bonds), OJ (Orange Juice)

News for the day:

Pending Home Sales: 10:00a

Dallas Fed Mfg Survey: 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:The S&P made fresh all-time highs on Friday before a late selloff which brought prices back into the high volume zone of 1800-1807. As a result, any trading within the range should see more two-sided trading as traders digest the pending home sales news this morning. The longer term bias is still clearly bullish, but prices are currently trading below the value area. It will be noteworthy to see if buyers can lift the offers back inside value or if there is a liquidation break. Intraday bias is neutral/short.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment