Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Net Long

Inside Day/Outside Day: Inside

Location of price relative to market profile: Near value area high

Notable overnight futures markets changes:

Up:NG (Nat Gas), SB (Sugar)

Down: SI (Silver), CC (Cocoa), ZO (Oats), PL (Palladium), GC (Gold), ZM (Soybean Meal), ZS (Soybeans), ZC (Corn), ZW (Wheat)

News for the day:

Pending Home Sales Index: 10:00a

Dallas Fed Mfg Survey: 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

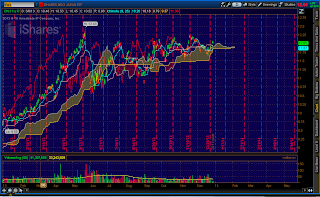

Projected ES price action for the day: The trend continues upward as trading has been net long during the overnight session. The S&P closed on Friday near the all-time highs of 1840 and the higher probability is for a test of the level when the market resumes pit trading on Monday morning. The volume should be lighter due to the New Year's holiday, but we could see some volatility as institutions book profits for the calendar year. The long term bias continues to be bullish and the intraday bias is neutral/bullish.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment