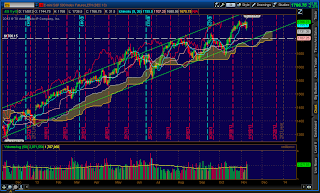

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Outside

Location of price relative to market profile: Above value area

Notable overnight futures markets changes:

Up: NKD (Nikkei), PL (Palatium), SI (Silver), GC (Gold), OJ (Orange Juice), ZW (Wheat)

Down:NG (Nat Gas), CL (Oil), 6J (Yen)

News for the day:

International Trade: 8:30a

Jobless Claims: 8:30a

Productivity & Costs: 8:30a

Petroleum Status Reports: 11:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:

The trend continues to remain bullish as the S&P made all-time highs yesterday after a late afternoon buying spree. There are two noticeable points to analyze: 1) The majority of the buying occurred in the afternoon. Typically, the most momentum is generated during the AM session as that is when the majority of institutional investors place their trades. 2) A new all-time high was made during the overnight session. Usually, a new high is made during Regular Trading Hours so at this point, the signs are pointing for at least a test of the overnight high. If bears can get prices back inside yesterday's range then there could be some choppy action, but higher probability is for further buying when the market opens.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish