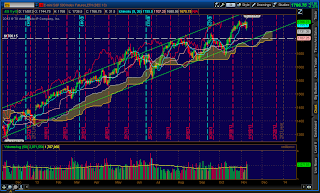

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile: Near value area high

Notable overnight futures markets changes:

Up: ZC (Corn), CT (Cotton), ZW (Wheat)

Down: PA (Palladium), PL (Platinum)

News for the day:

Veteran's Day: Stock market open; bond market closed

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: With today being Veteran's Day and the bond market closed, the higher probability is for more range bound price activity. The S&P and bond futures are levered together and when one of the markets is closed, it is more difficult to sustain intraday momentum. Given the large value area on Friday after the jobs report, the likelihood is for prices to trade within the zone. Typically, on holidays when the markets are still open, there is significantly less volume and market makers establish a wide 5 minute opening range and trade within it for most of the day. The better play for today is to fade support/resistance levels, especially when the pace of the tape slows.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment