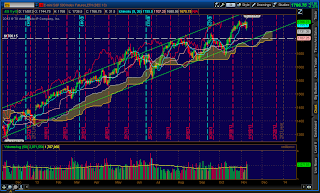

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Neutral

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile: Below value area

Notable overnight futures markets changes:

Up: NKD (Nikkei), ZL (Soybean Oil), NG (Nat Gas), ZC (Corn), CT (Cotton), CC (Cocoa), KC (Coffee), ZW (Wheat)

Down:SI (Silver), 6B (Pound), HG (Copper)

News for the day:

NONE

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Yesterday's profile showed an extremely normalized distribution with prices trading in a narrow range due to the holiday. As a result, the previous day's high (1770.25) & low (1764) serve as strong reference points for today's trading. Anything above 1770.25 and edge to the bulls as the market once again approaches all-time highs. Anything below 1764 and the bears will look to push prices lower to the VPOC at 1760.75. There is no major news announcements, so if there is any directional movement, it likely will be done by short-term traders.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment