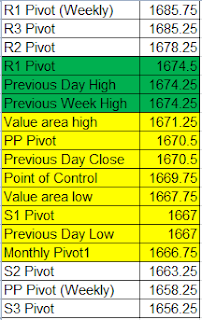

Major Support/Resistance Levels- ES

Daily Outlook

Prior Day Market Sentiment:Neutral/Bullish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile: Above value area

Notable overnight futures markets changes:

Up: NKD, NG

Down: ZC, ZW, CL, 6J

News for the day:

Retail Sales: 8:30a

Empire State Mfg Survey: 8:30a

Business Inventories: 10a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Prices should open between value area high (1671.25) and the previous day high (1674.25). If prices react positively to the premarket news, look for a test of the previous day high. If prices are accepted above this level, then the next target would be a VPOC at 1676.75 and above. However, if sellers step in, there should be a test of the value area high. If prices are accepted into value then the higher probability would be for the market to be setting up for a balancing day.

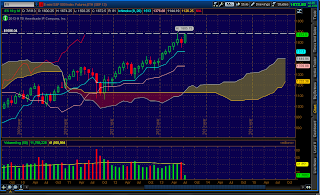

Stock of the Day: Citigroup (C)

Earnings today and and bullish cloud break

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment