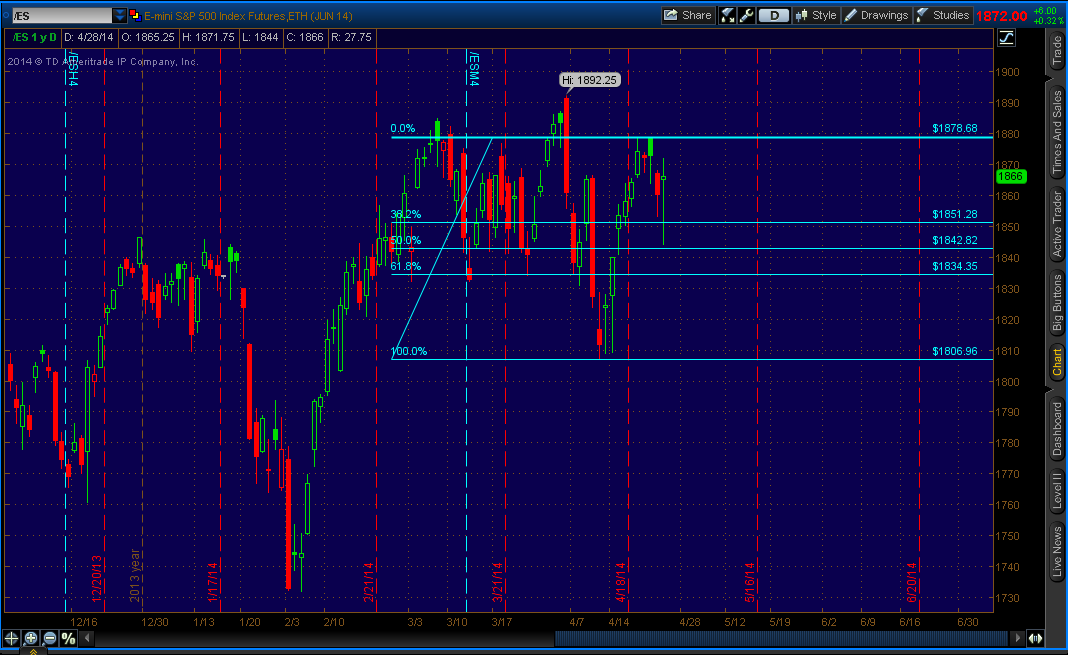

Major Support/Resistance Levels- ES

Daily Outlook

Prior Day Market Sentiment:Bullish

Overnight Inventory Change: Net short

Inside Day/Outside Day:Inside

Location of price relative to market profile:Near value area low

Notable overnight futures markets changes:

Up: SB (Sugar)

Down: KC (Coffee), SI (Silver), CL (Crude Oil), NKD (Nikkei), ZC (Corn), PA (Palladium), PL (Platinum), ZW (Wheat), ZL (Soybean Oil)

News for the day:

ADP Employment Report: 8:15a

GDP: 8:30a

Employment Cost Index: 8:30a

Chicago PMI: 9:45a

Petroleum Status Report: 10:30a

FOMC Minutes: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:The S&P has continued with a balanced profile after Monday's wide range trading day. With the pending Fed minutes to be announced at 2pm this afternoon, the likelikhood is for lower volatility as long term fundamental traders position themselves for market entry when the interest rate news is given to provide clues of future market direction. Trading in the premarket has seen some selling, all within the context of Tuesday's range. As a result, the key reference levels will be the previous day high and low of 1875.25 & 1865.25. Intraday edge is neutral.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish