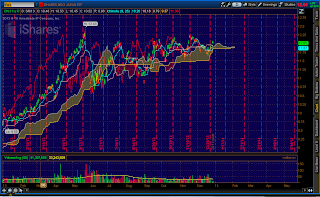

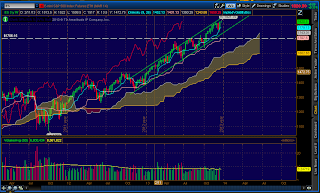

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Neutral/Bearish

Overnight Inventory Change:Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile: Near POC

Notable overnight futures markets changes:

Up:SB (Sugar), ZL (Soybean Oil)

Down: NG (Nat Gas), KC (Coffee), PL (Platinum)

News for the day:

S&P Case Shiller HPI: 9:00a

Chicago PMI: 9:45a

Consumer Confidence: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The S&P has formed a basing pattern heading into the New Year. Prior to yesterday, the index had seen increasing value areas for five days in a row before leveling and trading horizontally during Monday's session. Given the lower holiday volume heading into the New Year and the overnight price activity trading right at the point of control, the higher probability is for two-sided trading heading into 2014. Happy New Year!

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish