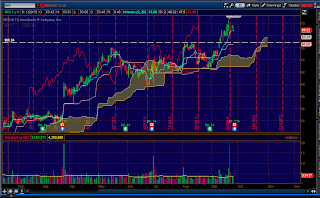

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Inside

Location of price relative to market profile: At POC

Notable overnight futures markets changes:

Up: NKD, SI, CL

Down:ZC

News for the day:

GDP: 8:30a

Jobless Claims: 8:30a

Pending Home Sales Index: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The ES looks to open within the value area so the higher probability is for two-sided action. The overnight inventory is net long so it will be important to see what traders do at the open. Watch for large size and if there is a liquidation, the target will be the gap fill at 1686.25, which also happens to be value area low. If buyers lift the offer, then the key resistance level will be the high volume point at 1695.

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment