Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile: Near POC

Notable overnight futures markets changes:

Up: SI, NG, ZW

Down:CL

News for the day:

Existing Home Sales- 10:00a

Petroleum Status Report- 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

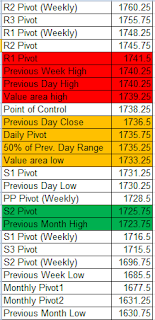

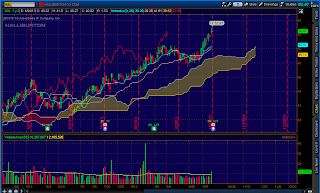

Projected ES price action for the day: It's up, up, and away for the markets as the ES made all-time highs on Friday. After the overnight activity, prices look to open near the POC, indicative of balance before the US markets open. As a result, if prices clear and hold above 1740.25 there will be a clear edge to the bulls due to the lack of overhead supply and the continued demand of buyers and would set up for another trend day higher. On the flipside, if bears keep it an inside day and within the value area, then two-sided trading should be expected and profit targets/stops should be kept close. Finally, the monthly jobs report will be released tomorrow morning, so range bound activity is more probable during afternoon trading as large investors get their positions in place for the news.

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment