Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change:

Inside Day/Outside Day:Inside

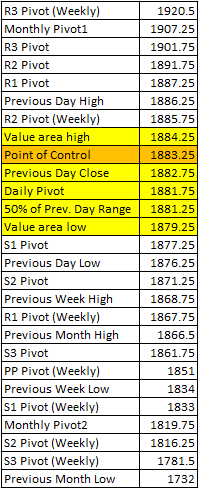

Location of price relative to market profile: At value area high

Notable overnight futures markets changes:

Up: ZL (Soybean Oil), ZC (Corn), ZS (Soybeans), ZM (Soybean Meal)

Down:NG (Nat Gas), SI (Silver), HG (Copper)

News for the day:

International Trade: 8:30a

Jobless Claims: 8:30a

ISM Non-Mfg Index: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: And just like that, the S&P is back to the all-time highs. It is a reminder of one of the most important rules of trading: never fight the Fed. With interest rates near 0% to spark the economy, large banks and hedge funds continue to buy up the contracts in droves. Ever since the bears attempted to sell the ES through the high volume range on 3/27, there has been 5 consecutive days of higher value areas, creating 4 new VPOCs below, a sign that the bulls have been aggressive in buying any dips. Tomorrow is the monthly jobs report number and it increases the likelihood of intraday volatility as macro traders position themselves for tomorrow. The key level for today is the all-time high of 1886.25. Intraday bias is bullish.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish

No comments:

Post a Comment