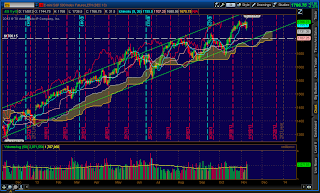

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Outside

Location of price relative to market profile:Above value area

Notable overnight futures markets changes:

Up: KC (Coffee), NKD (Nikkei), CT(Cotton), 6N (New Zealand Dollar)

Down:SB (Sugar), PA (Palladium), ZM (Soybean Meal)

News for the day:

Empire State Mfg Survey: 8:30a

Import & Export Prices: 8:30a

Industrial Production: 9:15a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The bias continue to be to the top side as prices have made another all-time high during the overnight session. As a result, the key level of support will be the previous day high of 1789. If there is any selling at the open and buyers prop prices above the level, then continued buying should be expected. Prices typically don't make highs during the European session, so the higher probability is at least a test of the price point. At this point, the bears will look to get prices within yesterday's range, but they have their work cut out for them. Edge to the bulls.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment