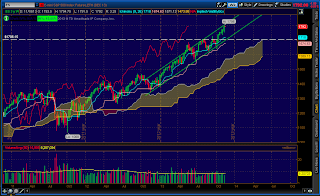

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:Below value area

Notable overnight futures markets changes:

Up: ZW (Wheat), ZO (Oats), NG (Nat Gas), 6A (Aussie Dollar)

Down:--

News for the day:

Employment Cost Index: 8:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:Yesterday was the first bearish day we've seen in what seems like a long time. The late afternoon liquidation break saw the bulls do some profit taking and the bears riding the wave of the selloff. As a result, the point of reference for today will be Monday's low of 1784.75. If prices can clear and hold then there is room to run to the previous week's high. On the other hand, if the bulls can keep the market within Monday's range, then there should be more choppy action, particularly if prices climb back into the value area. Longterm edge clearly still is with the bulls, but the path of least resistance on an intraday basis is with the bears.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment