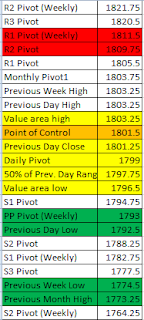

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Outside

Location of price relative to market profile: Above value area

Notable overnight futures markets changes:

Up: NG (Nat Gas), CT (Cotton), NKD (Nikkei), ZW (Wheat)

Down:RB (Heating Oil), CL (Crude Oil), HO (Heating Oil), GC (Gold), SI (Silver)

News for the day:

Pending Home Sales Index: 10:00a

Dallas Fed Mfg Survey: 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The S&P made a new all-time high during the overnight session and traders continue to buy these markets in droves. 1800 is a well defined trading level and should provide a strong area of support for the bulls, but the edge is clearly to the bulls until proven otherwise.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment