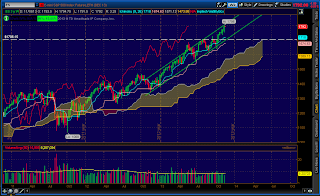

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral/long

Inside Day/Outside Day: Inside

Location of price relative to market profile: Near value area low

Notable overnight futures markets changes:

Up: NKD (Nikkei), ZL (Soybean Oil), ZC (Corn), ZS (Soybean), PA (Palladium)

Down:CC (Cocoa), GC (Gold), 6J (Yen), 6A (Aussie Dollar), 6N (New Zealand Dollar), SI (Silver)

News for the day:

Jobless Claims: 8:30a

Producer Price Index: 8:30a

PMI Mfg Index: 8:58a

Philadelphia Fed Survey: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Yesterday's profile showed a double distribution after the Fed meeting announcement. There was a liquidation break as prices spent time below Tuesday's trading range, a bearish sign. Prices are relatively neutral during the overnight session and are set to open inside the value area. Therefore, the value area high/low will be the reference points to watch for the day. There has been some profit taking with the bulls and a volume cluster is building between 1785-1800, so the intraday edge is with the bears.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment