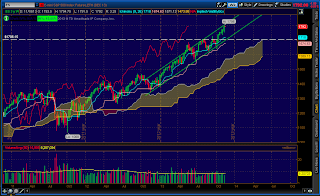

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile:At POC

Notable overnight futures markets changes:

Up: NG (Nat Gas), CT (Cotton), ZL (Soybean Oil), KC (Coffee)

Down:GC (Gold), PL (Platinum), PA (Palladium), RB (Heating Oil)

News for the day:

CPI: 8:30a

Retail Sales: 8:30a

Business Inventories: 10:00a

Existing Home Sales: 10:00a

Petroleum Status Report: 10:30a

FOMC Minutes: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: We've been seeing mostly two-sided trading for the past few days and the overnight session generated similar results. At this point, the S&P looks to open inside Tuesday's range and right at the POC, making it a coin flip for intraday price action. Therefore, the clearance of previous day high/low will give further clues to any directional trading activity. There is significant news at 8:30a which should provide a catalyst for the bulls or bears. The path of least resistance is with the bears,however, as there is still a VPOC to fill all the way at 1763.25 after the bullish price activity last week.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment