*For FREE lessons on the Ichimoku Cloud and how it works, check out my other

blog-

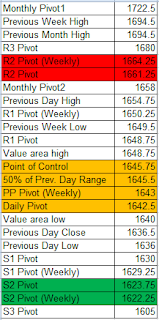

Major Support/Resistance Levels- ES

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change:Bullish

Inside Day/Outside Day: Inside

Location of price relative to market profile: Between POC & value area low

Notable overnight futures markets changes:

Up:NG, CT, DX, Indexes

Down: ZC, ZS, 6J, ZW, 6S, ZB, 6E

News for the day:

Jobless Claims: 8:30a

PMI Manufacturing Index: 8:58a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Prices look to open within the value area after yesterday's roller coaster in price action after the FOMC minutes. The overnight volume is mostly long so the bulls will look to generate momentum and lift prices above the value area high of 1648.75. Sellers will look to test the 1636 level and if the bears can gain some traction the next level of support is at 1630.

Stock of the Day: Abercrombie & Fitch (ANF)

*Bearish cloud break heading into earnings

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment