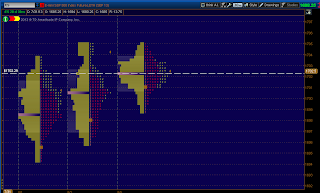

Major Support/Resistance Levels- ES

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Neutral

Overnight Inventory Change:Net Short

Inside Day/Outside Day:Inside

Location of price relative to market profile: Below value area (as of 7:30am EST)

Notable overnight futures markets changes:

Up:ZW, NG, CL

Down:GC, KC

News for the day:

International Trade: 8:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: Yesterday's tape was incredibly slow as the ES remained inside Friday's trading levels. This is still a bullish sign as prices balanced in range. As the saying goes, "never short a dull market." Today, more volatility should be expected as traders look to capitalize on earnings news. The key support area if the ES sells is at 1694.5 where buyers could see opportunities at July's high price for the month. If prices move up and can clear 1705.5 then edge to the bulls.

Stock of the Day:Michael Kors Holdings Ktd (KORS)

*Earnings Before the bell. See additional blog post for full analysis.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment