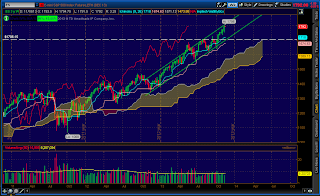

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Inside

Location of price relative to market profile:Above value area

Notable overnight futures markets changes:

Up: SB (Sugar), NG (Nat Gas)

Down:ZC (Corn), RB (Heating Oil), SI (Silver), ZO (Oats), PL (Palatium), NKD (Nikkei), HO (Heating Oil), GC (Gold), CL (Crude Oil)

News for the day:

Treasury International Capital: 9:00a

Housing Market Index: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:The S&P is poised to open near Friday's high and once again made a new all-time high during the overnight session. This type of price action is very bullish because it is indicative that traders overseas are finding value in the markets and are lifting offers even before the US markets open for business. Similar to Friday, the previous day high of 1796 will be the line in the sand. If prices hold above, then continued buying pressure should be expected. Bears, tread carefully. Edge to the bulls.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment