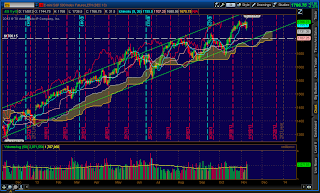

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bearish

Overnight Inventory Change: Net short

Inside Day/Outside Day: Inside

Location of price relative to market profile: Between POC & value area low

Notable overnight futures markets changes:

Up: HO (Heating Oil), CT (Cotton), NG (Nat Gas), ZL (Soybean Oil)

Down: HG (Copper), OJ (Orange Juice)

News for the day:

Treasury Budget: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The S&P has been in a basing pattern for the past two weeks on relatively lower volume, even after the monthly jobs report. There have been mostly small size bodied candles with wicks, which is indicative of two-sided trading. While the momentum has slowed, the price action is still bullish since any horizontal trading is a sign that buyers are supporting the market until proven otherwise. The market looks to open inside of the value area so value area high (1766.5) and value area low (1761.5) will be the key levels to watch for any directional trades.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment