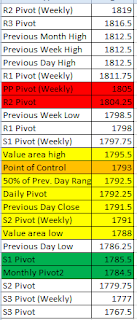

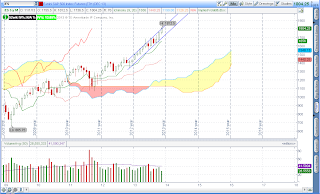

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Neutral

Inside Day/Outside Day: Inside

Location of price relative to market profile: Near POC

Notable overnight futures markets changes:

Up: CL (Crude Oil), ZL (Soybean Oil), OJ (Orange Juice)

Down: CC (Cocoa), 6A (Australian Dollar), 6N (New Zealand Dollar), NKD (Nikkei), GC (Gold)

News for the day:

ADP Employment Report: 8:15a

International Trade: 8:30a

New Home Sales: 10:00a

ISM Non-Mfg Index: 10:00a

Petroleum Status Report: 10:30a

Beige Book: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:The S&P saw the first selloff from the high volume zone of 1800-1810 with minimal volatility during the overnight session. Part of the reason for the neutral price action could be the monthly jobs report on Friday as longer term traders are on the sidelines until then when there could be more clarity about the fundamentals of the economy. As a result, the key levels for today are the value area high (1795.5) and value area low (1788). Trading inside value should be more choppy, especially near the POC. The long term bias is still bullish as there still has not been a major liquidation break and buyers continue to support the market. On an intraday basis, however, it is a coin toss.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment