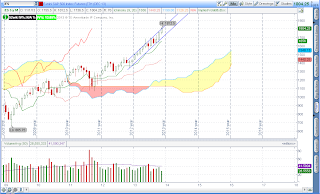

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Neutral

Overnight Inventory Change: Bearish

Inside Day/Outside Day: Inside

Location of price relative to market profile:Between POC & Value area low

Notable overnight futures markets changes:

Up: OJ (Orange Juice), NG (Nat Gas)

Down:SI (Silver), GC (Gold), KC (Coffee), NKD (Nikkei), ZW (Wheat), ZC (Corn), PL (Platinum), HG (Copper), ZO (Oats), CC (Cocoa)

News for the day:

GDP: 8:30a

Jobless Claims: 8:30a

Factory Orders: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:Despite the positive GDP news, the S&P has sold off in the premarket, but is still inside the value area. The value area low (1785) will be the first major level to watch today. If the selloff continues then Wednesday's low of 1777 is the next inflection point. On the other hand, if the offers are lifted, then the POC (1791) & value area high (1796) will be key for the bulls. Given the macro catalyst and the volatility in the premarket, there should be solid opportunities to trade today. Remember the reaction to the news always trumps the news itself and this is even more true when day trading futures.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment