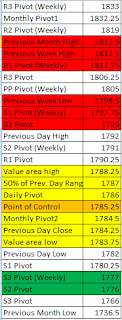

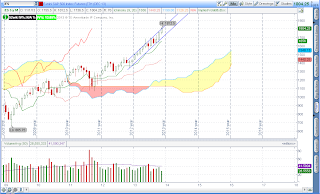

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bearish

Overnight Inventory Change: Net long

Inside Day/Outside Day: Inside

Location of price relative to market profile: Above value area high

Notable overnight futures markets changes:

Up: NKD (Nikkei), CC (Cocoa), SB (Sugar), KC (Coffee), RB (Heating Oil)

Down: PA (Palladium), PL (Platinum), SI (Silver), ZM (Soybean Meal), ZS (Soybeans)

News for the day:

Employment Situation: 8:30a

Personal Income & Outlays: 8:30a

Consumer Sentiment: 9:55a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day:Everything hinges on the jobs report this morning. The expectation is for 180K jobs created with an unemployment rate of 7.2%. Of course, the most important aspect is the market's reaction to the news. The trading has been neutral to bearish for the past week with the high volume zone still intact from 1800-1810. Therefore, if the news is bullish then 1800 will be the key level to watch. If there is a selloff after the announcement, then the level of support is at 1778. There should be significant volatility today so set wider stops and profit targets to account for the larger range. The news should serve as the necessary catalyst for a directional play so the higher probability is to trade with the trend.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment