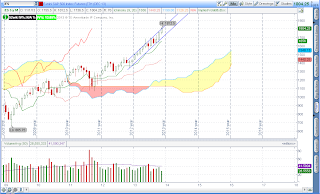

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Neutral

Overnight Inventory Change: Net short

Inside Day/Outside Day: Outside

Location of price relative to market profile: Below value area

Notable overnight futures markets changes:

Up:6B (British Pound)

Down:NKD (Nikkei), HG (Copper), SI (Silver)

News for the day:

NONE

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The S&P has sold off during the overnight session and are trading outside of yesterday's range which is a bearish sign. Look for a test of Monday's low of 1797 as the "line in the sand" level for the day. If the bears protect it, then further selling is likely. Anything within the 1800-1810 should see more neutral price activity, as the range is both inside the value area as well as the high volume zone on the weekly profile distribution. Intraday bias is to the short side.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment