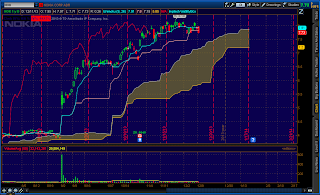

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change: Net short

Inside Day/Outside Day: Outside

Location of price relative to market profile:Below value area

Notable overnight futures markets changes:

Up: CC (Cocoa), NG (Nat Gas), 6N (New Zealand Dollar), NKD (Nikkei), KC (Cotton)

Down:SI (Silver), GC (Gold), PA (Palladium), PL (Platinum), CT (Cotton), ZM (Soybean Meal), ZS (Soybeans)

News for the day:

Jobless Claims: 8:30a

Retail Sales: 8:30a

Import & Export Prices: 8:30a

Business Inventories: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The S&P saw a massive selloff yesterday after news that tapering by the Fed could begin sooner rather than later. Prices have continued to sell in the premarket with news catalysts upcoming that potentially could provide further directional trading. Watching the open will be important to see if some profit taking occurs in bringing the trading back into Wednesday's range. Given the wide value area, a high probability trade would be to fade value area low/high. Any trading below the previous day low of 1779.25 should see further selling as many alogrithmic trading programs are activated during outside days. At this point, edge to the bears.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment