*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change:Net long

Inside Day/Outside Day: Outside

Location of price relative to market profile:Above value area

Notable overnight futures markets changes:

Up:NKD (Nikkei), PL (Palladium), 6B (British Pound), RB (Heating Oil)

Down: CC (Cocoa), 6N (New Zealand Dollar), KC (Coffee), NG (Nat Gas), ZM (Soybean Meal), ZC (Corn), ZS (Soybeans), ZW (Wheat), SB (Sugar)

News for the day:

Housing Starts: 8:30a

Industrial Production: 9:15a

Consumer Sentiment: 9:55a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The S&P is poised to open higher after buying activity during the overnight session. As of this writing, prices are hovering right at Thursday's high of 1841. Any trading above this level can be construed as bullish and draw attention from more buyers looking to make new all-time highs. Ever since the beginning of the New Year, prices have been propped up near the highs which is indicative of the longer timeframe bulls buying on any dips. It is options expiry Friday and there is typically more two way trading as traders cover or roll their positions to future option dates. Bulls are on parade until proven otherwise. Long term bias is bullish; intraday bias is neutral/bullish.

ES Daily Trend: Bullish

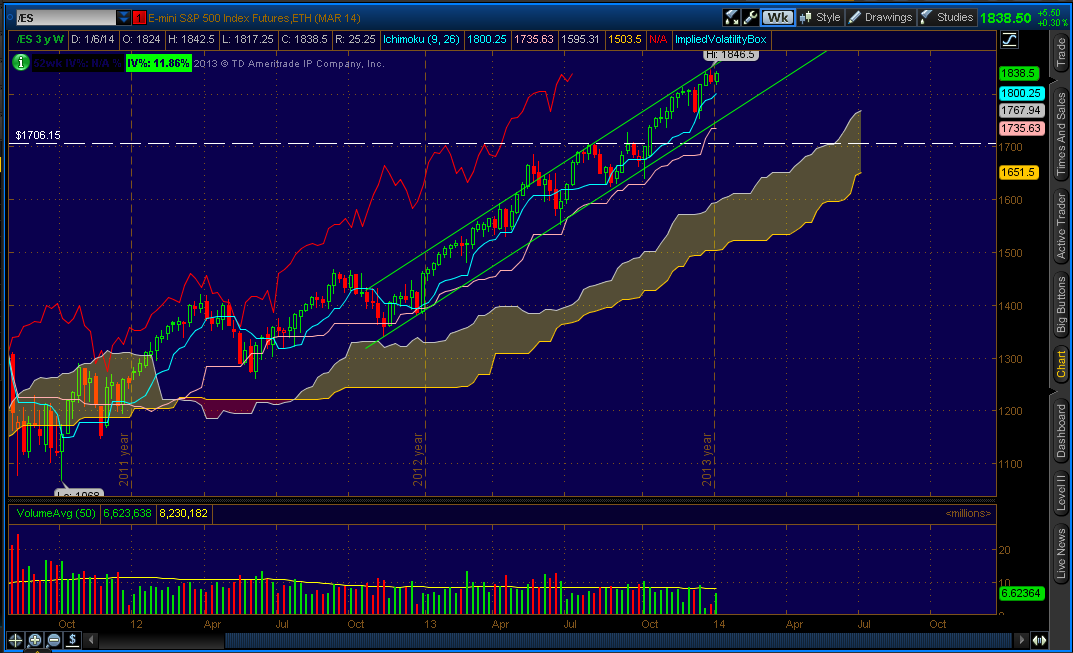

ES Weekly Trend: Strongly Bullish

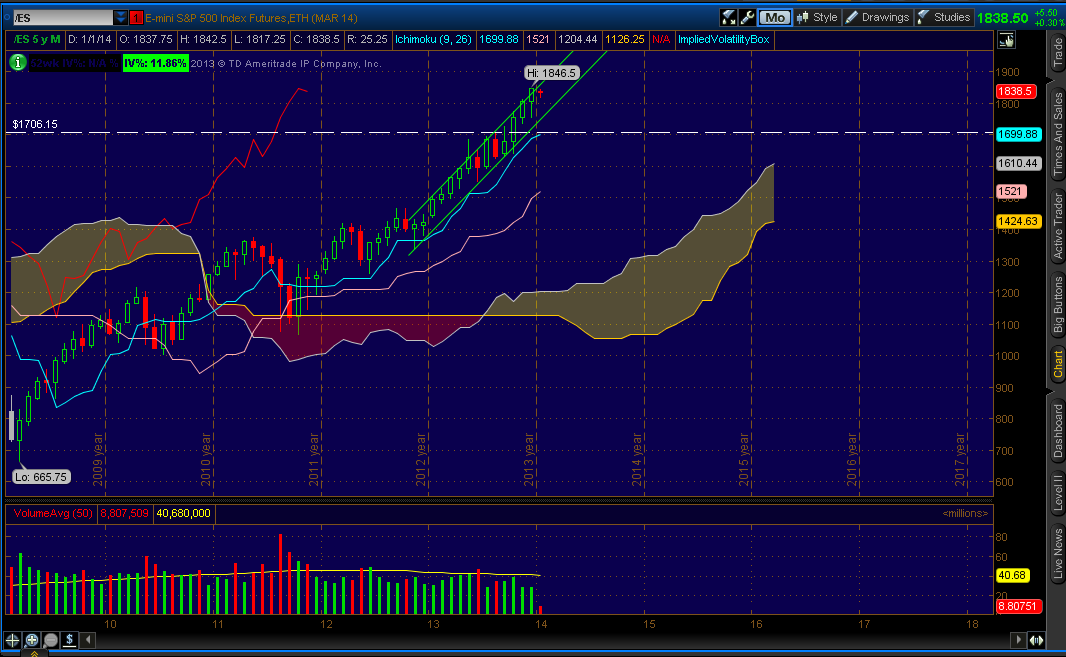

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment