*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Net short

Inside Day/Outside Day: Inside

Location of price relative to market profile:

Notable overnight futures markets changes:

Up:NG (Nat Gas), KC (Coffee), ZO (Oats)

Down: 6A (Aussie Dollar), NKD (Nikkei), SI (Silver)

News for the day:

Consumer Price Index: 8:30a

Jobless Claims: 8:30a

Treasury International Capital: 9:00a

Philly Fed Survey: 10:00a

Housing Market Index: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

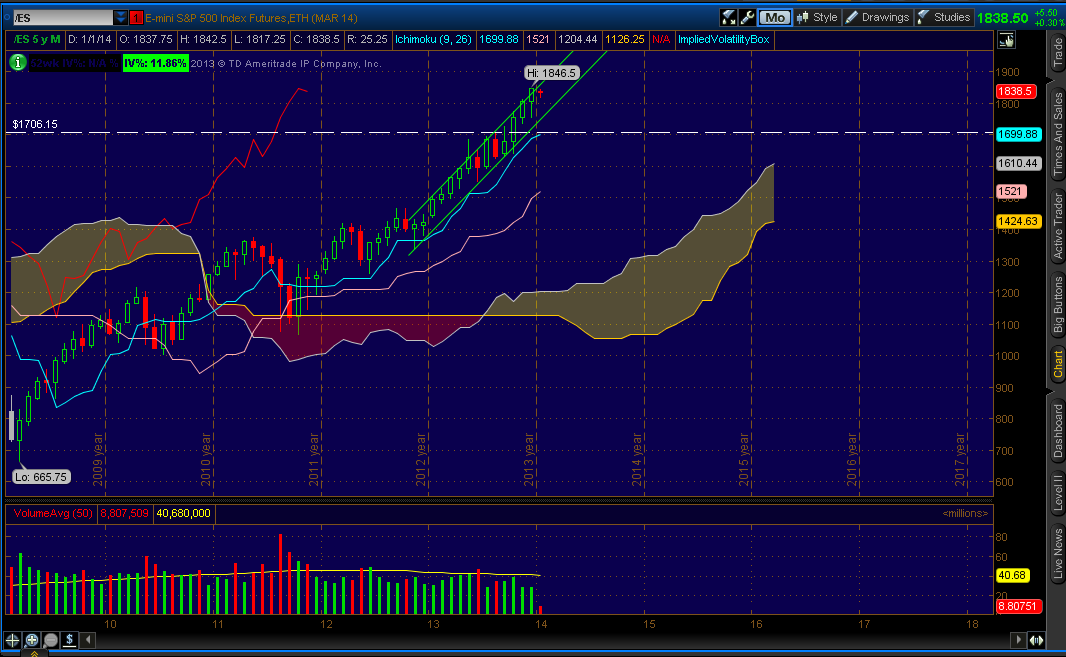

Projected ES price action for the day: The buyers continue to be alive and well given the current market conditions. Yesterday's trading activity was an upwards follow up to the bounce back day from Tuesday, providing confirmation that the bulls are exceeding expectations. There was a test of the all-time high of 1846.5, but prices bounced from the level and traded in balance for the duration of the day. That high would be the natural level to watch when the market opens. There has been some minor selling in the premarket right to the top of the high volume node from 1838-1825. If prices retrace back into the area then the higher probability is for more two-way trading. Long term bias is bullish; intraday bias is neutral.

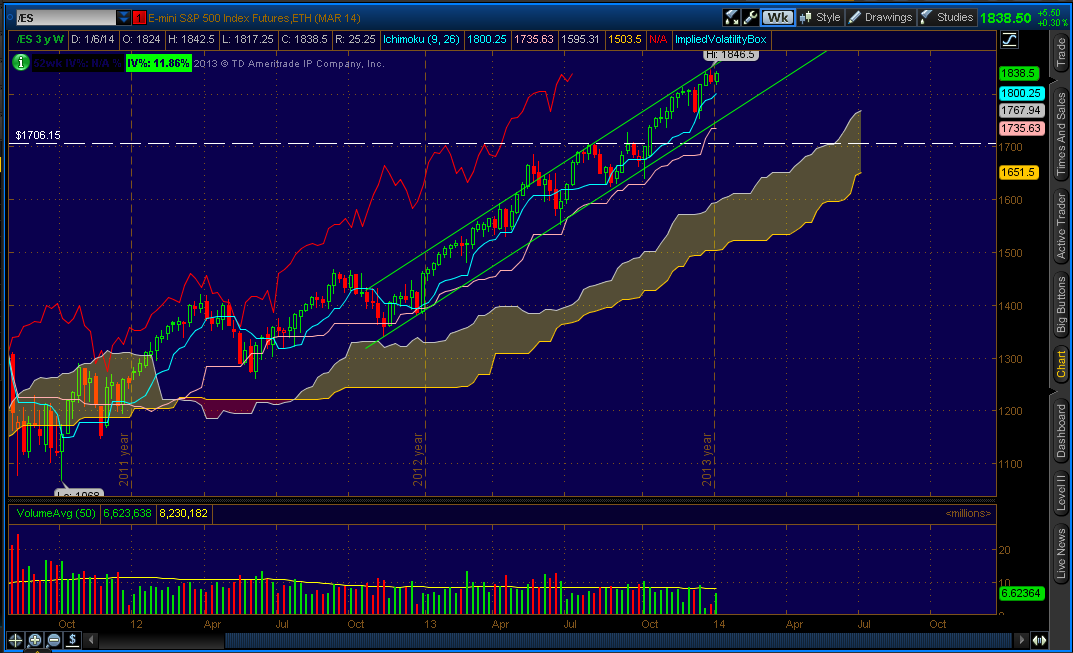

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment