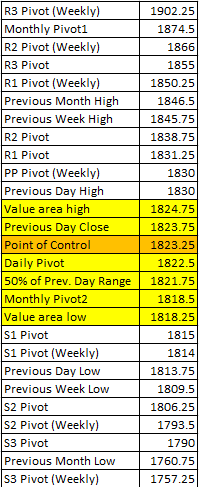

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment:Bearish

Overnight Inventory Change: Net short

Inside Day/Outside Day: Outside

Location of price relative to market profile:Below value area

Notable overnight futures markets changes:

Up:NG (Nat Gas), SI (Silver), 6J (Yen), ZO (Oats), GC (Gold)

Down: NKD (Nikkei), 6M (Peso), ZL (Soybean Oil), PL (Palladium), 6A (Aussie Dollar), ZS (Soybeans), KC (Coffee), Indexes

News for the day:

NONE

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: After yesterday's selloff and continued bearish activity during the overnight session, there is starting to be more of a bearish sentiment as prices are selling through the high volume zone that has been accumulating since the beginning of the New Year. The last time this occurred on Jan. 14th, the bulls bought up the markets in full force and lifted the offers back into the 1825-1840 balance area. The key inflection point for today's trading will be at 1810. It will be noteworthy to see if prices sell through the support level and, if it does, the profit target will be the whole number of 1800. Keep in mind that we are in a strong long term uptrend, but the intraday bias is clearly bearish.

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment