*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change:Net long

Inside Day/Outside Day: Outside

Location of price relative to market profile:Above value area

Notable overnight futures markets changes:

Up:NG (Nat Gas), CC (Cocoa), CT (Cotton), CL (Crude Oil)

Down: SB (Sugar), PL (Palladium), SI (Silver), GC (Gold)

News for the day:

Producer Price Index: 8:30a

Empire State Mfg Survey: 8:30a

Petroleum Status Report: 10:30a

Beige Book: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

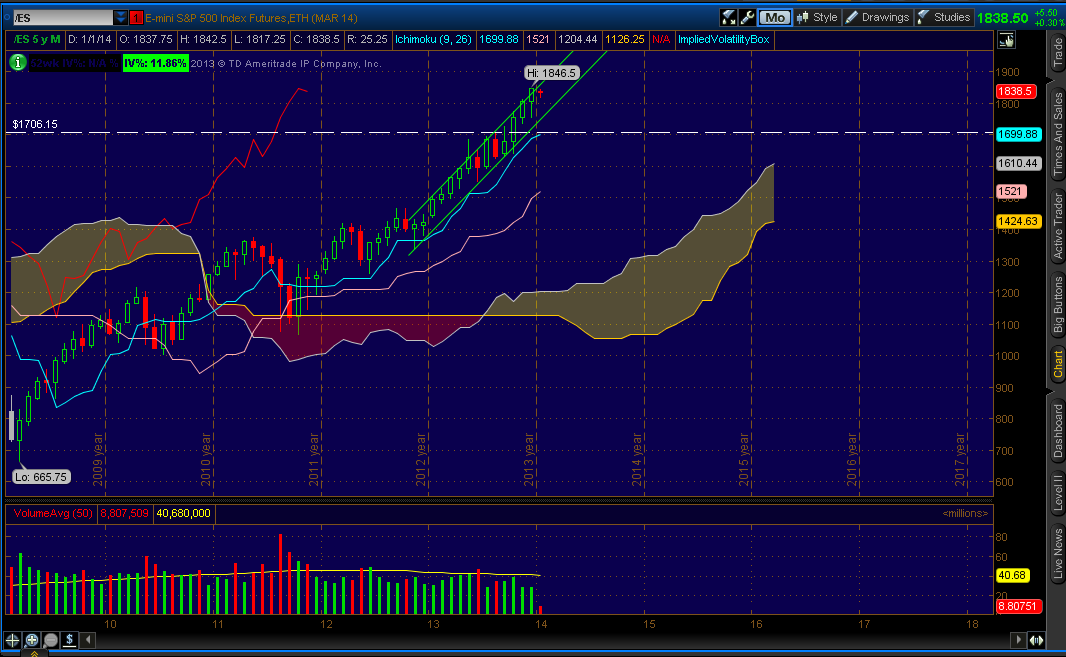

Projected ES price action for the day: The bulls are persistent. Yesterday saw one of the biggest bounce back days in years after a broad market selloff on Monday. Not only did the buyers manage to lift the offers back into the weekly high volume range of 1825-1838, they also brought the POC together with it. While it is fairly common to see spinning top patterns on a chart (where the candlesticks have approximately the same high/low/close on consecutive days), what is striking about the price action the past two days is the width of the bars and the distance that price had traveled only to return to the balancing area. The buying continued during the overnight session as prices have risen above yesterday's range. 1838 is the first inflection point to watch to the topside followed by the all-time high of 1846.5. Any trading within the high volume area should continue to see two-sided trading, but expect a flush of buyers to push prices through the 1838 target if it gets to that point. Intraday edge back to the bulls.

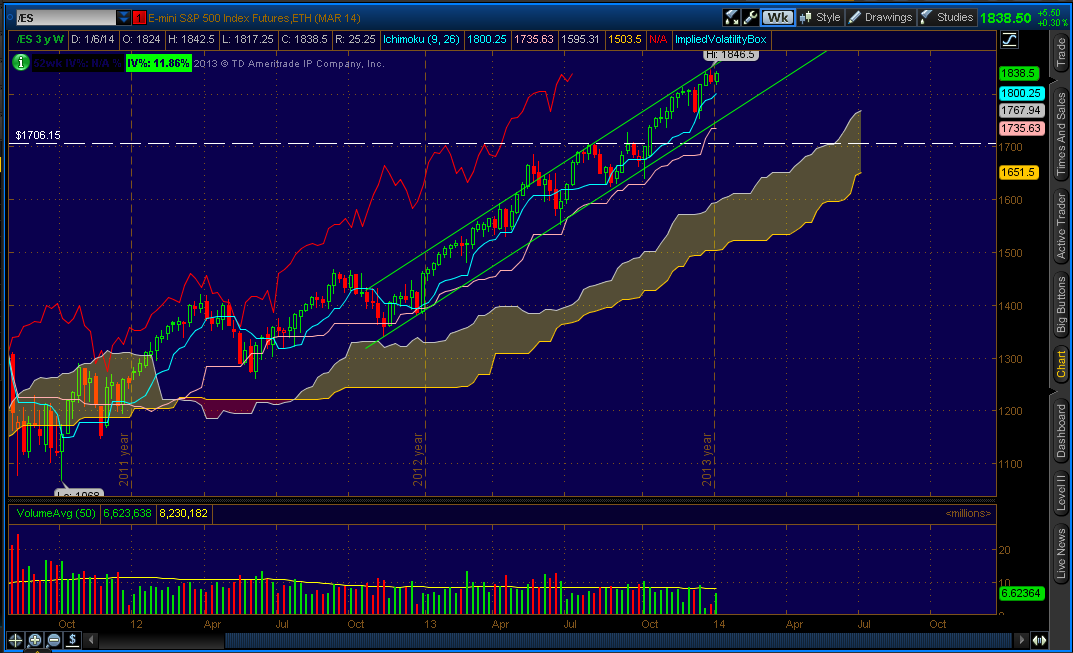

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment