*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change:Net Short

Inside Day/Outside Day: Inside

Location of price relative to market profile:Near POC

Notable overnight futures markets changes:

Up:NG (Nat Gas), ZW (Wheat), 6A (Australian Dollar), 6N (New Zealand Dollar), 6J (Yen)

Down: Nikkei (NKD), PA (Palladium), CL (Crude Oil), ZM (Soybean Meal), SI (Silver), HG (Copper)

News for the day:

Treasury Budget: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The theme for the S&P recently has been balance and we have seen more of the same to open the new trading week. In the long term, this is more of a bullish pattern as buyers continue to prop up the prices near the all-time highs while the bears cannot gain any sell side momentum. Looking at Friday's profile, prices closed near the highs while value remained lower, resulting in a corrective selloff back into range during the Euro session. A significant amount of time and volume has been spent between 1825-1838 which has displayed two-sided trading. Additional time spent in the zone should be traded with closer profit targets and stop loss points as traders have been fading both sides. Until prices breakout of the area, more of the same should be expected. Intraday bias is neutral/bearish.

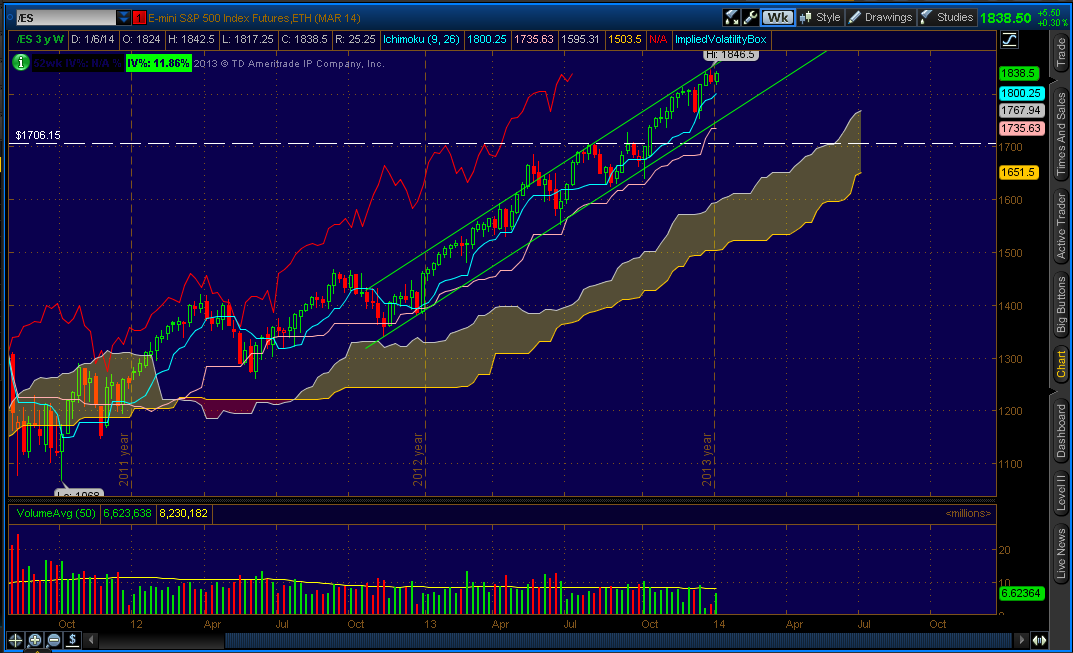

ES Daily Trend: Bullish

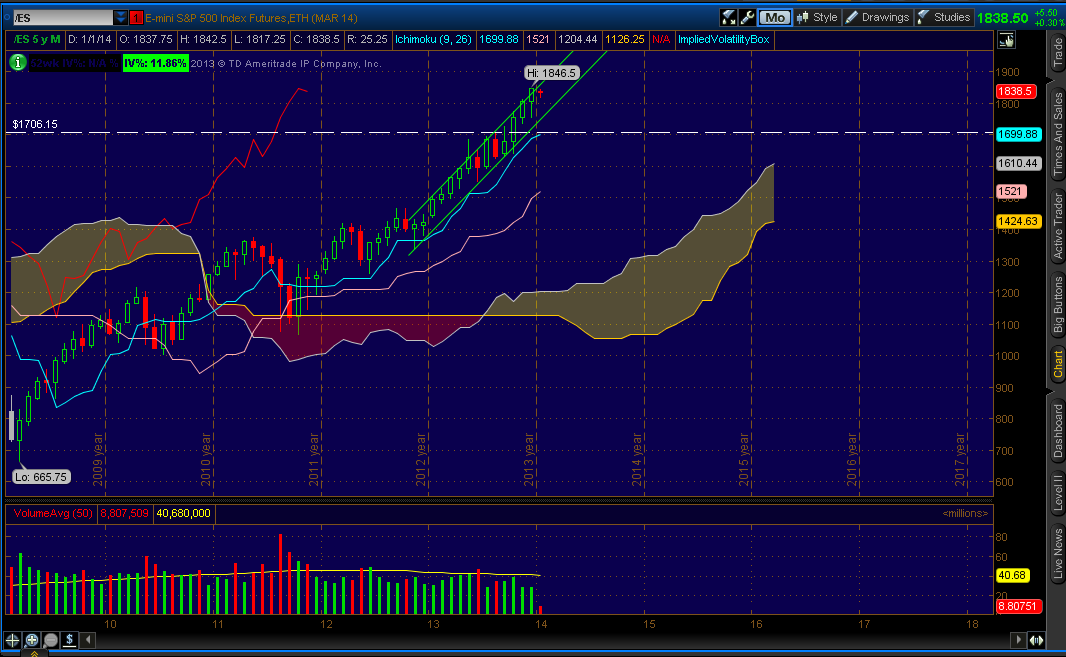

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment