*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change:Neutral/Net long

Inside Day/Outside Day: Inside

Location of price relative to market profile:Near value area low

Notable overnight futures markets changes:

Up:NG (Nat Gas), ZM (Soybean Meal)

Down: VX (VIX), PL (Platinum), 6A (Aussie Dollar), 6J (Yen), SI (Silver), KC (Coffee)

News for the day:

Retail Sales: 8:30a

Import & Export Prices: 8:30a

Business Inventories: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: The S&P saw it's first major intraday selloff in what seemed like ages. Prices had been primarily range bound during the morning session, but the afternoon session was all for the bears. The trading area of balance had been between 1825-1838 and a momentum of sellers was needed to push prices through the zone combined with the longs who had to cover their positions. As a result, the next target to the short side is the VPOC at 1801.5 and the whole number of 1800. There has been some profit taking during the overnight session as prices have been lifted inside of yesterday's range. At this point, the bulls will look to get prices back inside the value area and retest the 1825 level. On an intraday basis, the bias is neutral/bearish.

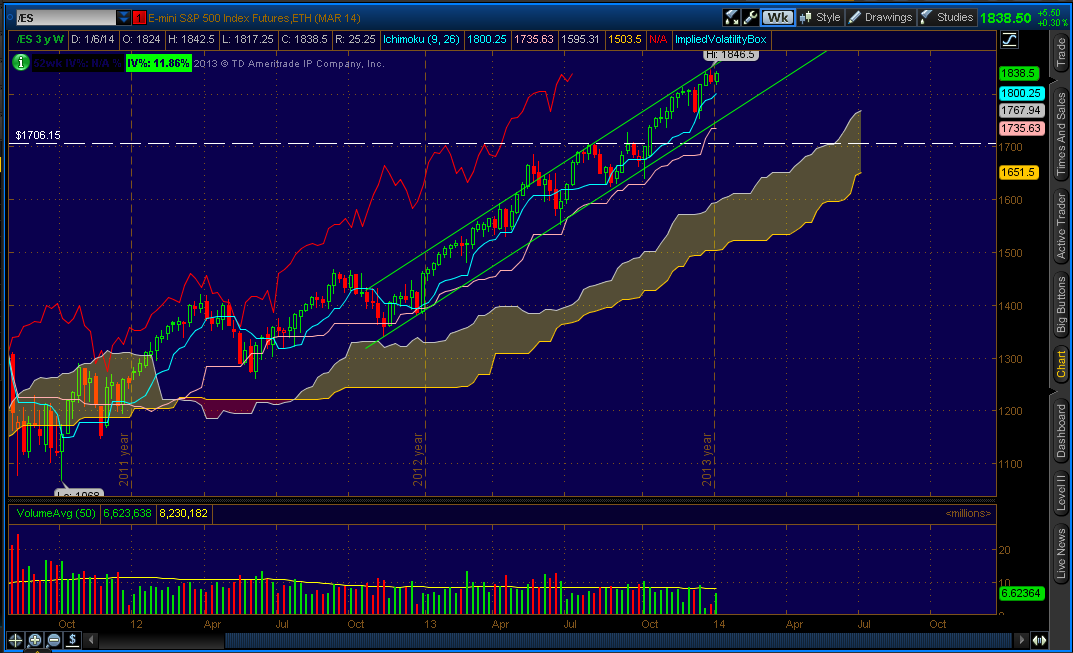

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

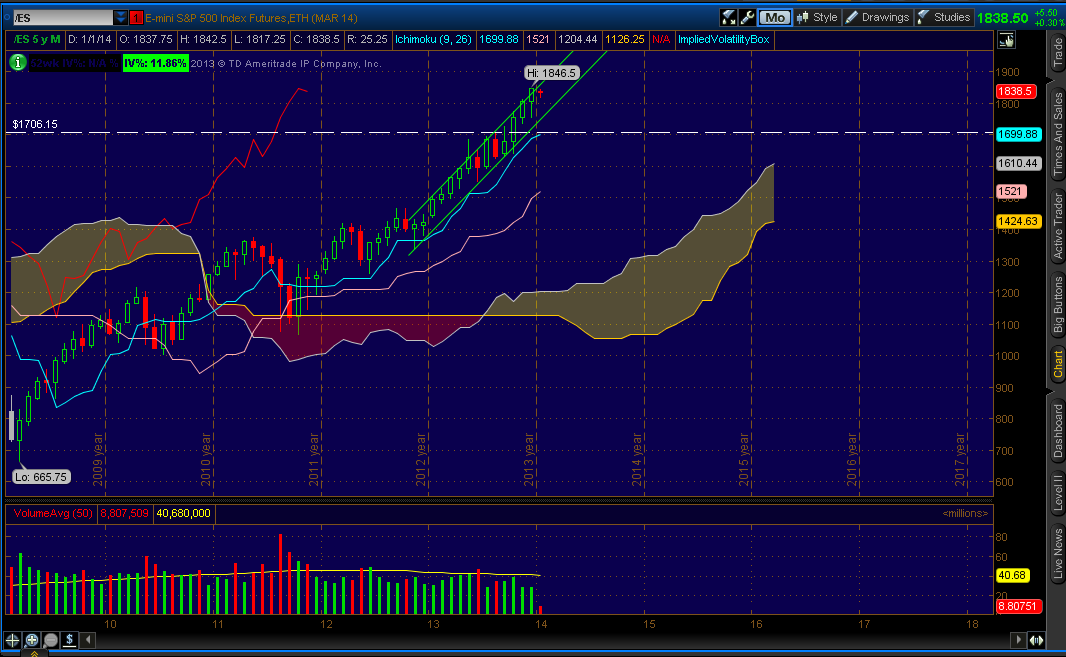

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment