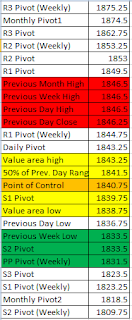

*Highlighted regions denote strong areas of support (green)/resistance (red) & mid-range level (brown)

Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change:Net short

Inside Day/Outside Day: Outside

Location of price relative to market profile:Below value area

Notable overnight futures markets changes:

Up: SI (Silver), GC (Gold), NG (Nat Gas), PL (Platinum), DX (Dollar), KC (Coffee)

Down: HO (Heating Oil), 6N (New Zealand Dollar), 6E (Euro), 6A (Australian Dollar), CL (Crude Oil), NKD (Nikkei), 6B (British Pound)

News for the day:

Jobless claims: 8:30a

PMI Manufacturing Index: 8:58a

ISM Mfg Index: 10:00a

Construction Spending: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

Projected ES price action for the day: What a 2013 it was as the S&P was up close to 30% for the year. The first day of trading in the New Year has seen some profit taking as the ES has sold off in the premarket outside of Tuesday's range. Anytime there is selling outside of the previous day's trading area, the key level to watch is first the previous day low of 1836.75 and then the value area of low 1838.75. If selling continues at the open, a strong support zone is at 1833.5, so two scenarios are likely. Either the pace of sell orders slows on the tape and buyers step in to lift the offers or the pace of selling accelerates as prices burst through the zone. The difference is subtle but can be seen on the time & sales. On an intraday basis, the bias is to the short side at this point.

ES Daily Trend: Strongly Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment