Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change:Net long

Inside Day/Outside Day:Outside

Location of price relative to market profile: Above value area

Notable overnight futures markets changes:

Up: PA (Palladium), CT (Cotton), ZO (Oats), PL (Platinum), NKD (Nikkei), GC (Gold)

Down: ZS (Soybeans), ZL (Soybean Oil), ZM (Soybean Meal), KC (Coffee), SB (Sugar)

News for the day:

**NONE**

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

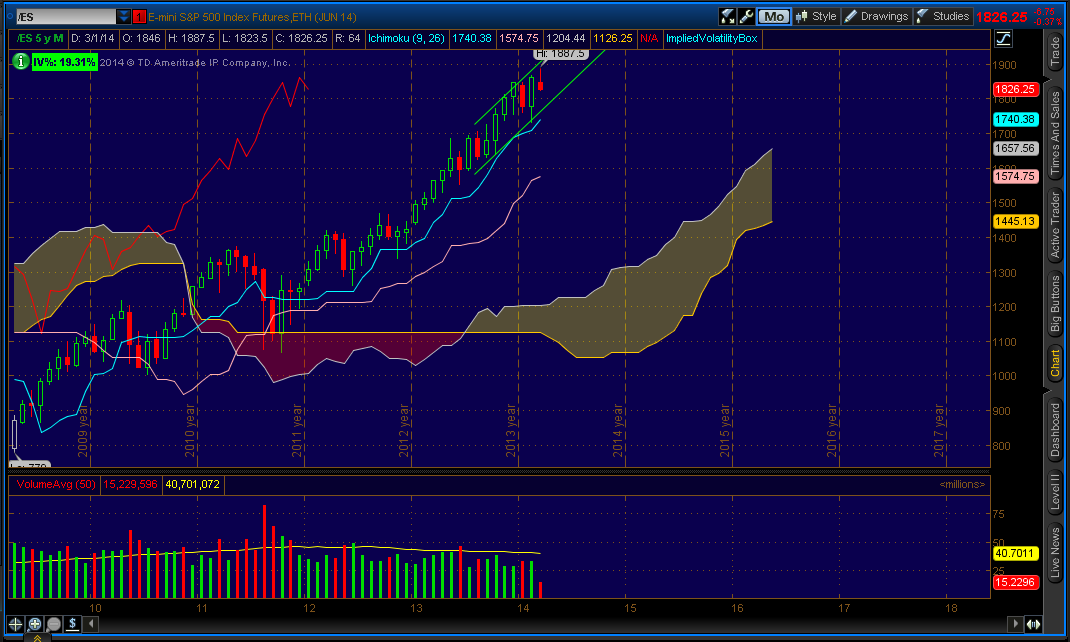

Projected ES price action for the day: The price action of the markets can be likened to the ebb and flow of the ocean. On all time frames from the 1 minute to the monthly chart, there is a constant rotation of buying and selling as the bulls and bears look to ride the wave of their intended trade. Dating back to 2013, the buyers had lifted the offers and bought on any dips as they saw value in the ES contracts after prices sold off. We are currently in a higher volatility market as there have been wide range candles in both directions for the past 3 days. Prices have risen above the zone during the globex session, making the breakout level of 1867 the key area to watch for today. Intraday edge is bullish.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish

No comments:

Post a Comment