Daily Outlook

Prior Day Market Sentiment: Neutral

Overnight Inventory Change: Bullish

Inside Day/Outside Day:Inside

Location of price relative to market profile: Above value area

Notable overnight futures markets changes:

Up: CT (Cotton), SB (Sugar), NKD (Nikkei), 6A (Aussie Dollar)

Down: KC (Coffee), HG (Copper), PA (Palladium)

News for the day:

Durable Goods Orders: 8:30a

Petroleum Status Report: 10:30a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

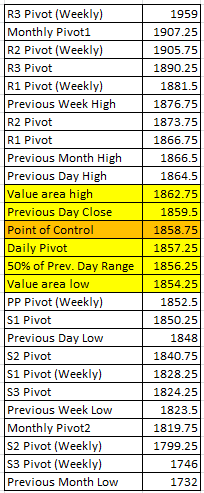

Projected ES price action for the day: The chart patterns found in the stock market can be likened to the runway at the airport. At any given moment, there are cross currents of planes headed to different destinations but all initially converged at a central location. Oftentimes, the jets have to circle the runway and wait for clearance from air traffic control before take off. The S&P is in one of those holding patterns at the moment. Yesterday marked the 7th day in a row where prices have consolidated in the 1840-1870 range, building a significant amount of volume in the process. Volatility has increased as prices explored higher and lower levels, but the value area has remained steady, a sign that the large traders are keeping prices in range until there are further developments that would force the hand of the bulls or the bears. Until there is a breakout of the zone, the day trading bias is a coin toss and the safer play is smaller profit targets and stops.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish

No comments:

Post a Comment