Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Neutral

Inside Day/Outside Day:Inside

Location of price relative to market profile: Near value area low

Notable overnight futures markets changes:

Up: ZM (Soybean Meal), CT (Cotton), ZS (Soybeans), ZC (Corn)

Down:NKD (Nikkei), SI (Silver), PA (Palladium), PL (Platinum), GC (Gold), NG (Nat Gas)

News for the day:

Consumer Price Index: 8:30a

Housing Starts: 8:30a

Treasury International Capital: 9:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

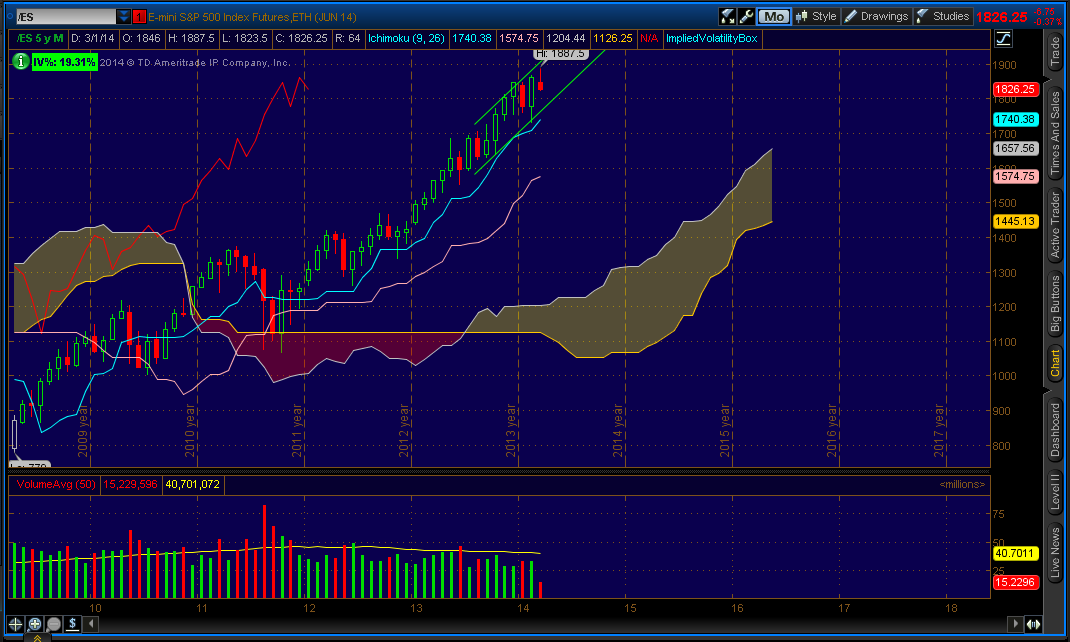

Projected ES price action for the day:On St. Patrick's Day, the markets were all green, up more than 1% for the day. The S&P is in a longterm uptrend, but in a downward channel on the 1 hour chart dating back to the beginning of March. When prices are trending in mixed directions on smaller and larger timeframes, it is usually indicative of two-sided price action. There has been buying during the globex session and the bulls will look to continue the upward momentum when the markets open for business. The key levels of reference will be the value area high/previous day high to the topside and value area low/previous day low if there is a liquidation break. Intraday edge is neutral/bullish.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish

No comments:

Post a Comment