Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change:Net long

Inside Day/Outside Day:Inside

Location of price relative to market profile: Near value area low

Notable overnight futures markets changes:

Up: NKD (Nikkei), ZW (Wheat), ZC (Corn), ZO (Oats), PA (Palladium), ZM (Soybean Meal), ZS (Soybeans)

Down: KC (Coffee), GC (Gold),SB (Sugar), SI (Silver)

News for the day:

PMI Manufacturing Index Flash: 9:45a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

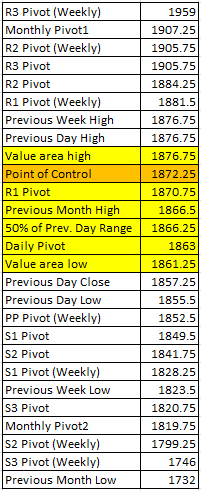

Projected ES price action for the day: The trading activity on the S&P can be likened to the path of a cruise ship on the open water. The captains of the ship are the large institutional banks and hedge funds who measure the scope of the macro economic climate and make their decisions about whether to continue on course of the given trend or reverse and start a counter trend shift in the markets. We are currently in the beginning of the latter where the water is starting to get more choppy in an attempt by the bears to sell the markets, but the bulls are still holding strong and keeping the value areas on the profile near the highs. Until there is confirmation (i.e. trendline break), it is safe to say the ship is still being steered by the bulls. The key level to watch will be the high volume price points on the composite profile of 1875 and 1860. Intraday edge is neutral/bullish.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish

No comments:

Post a Comment